Zip Co (ASX: ZIP) – a leading BNPL provider

ABOUT COMPANY

Zip Co (ZIP) (https://zip.co/au) is a Buy-Now-Pay-Later (BNPL) provider. It offers point-of-sale credit and payment solutions to customers and provides a variety of integrated Retail Finance solutions to merchants across numerous industries, both online and in-store.

CAPITAL STRUCTURE

| ASX Code | Share Price | Shares | Option (In) | Market Cap | Cash/Asset ($m) |

| Holders No | Top 20 (Cur) | Top 20 (Pre) | Director Hold | Performance Right | Note |

BUSINESS

Below is the company’s past five-year performance

| ZIP | 2023 | 2022 | 2021 | 2020 | 2019 |

| Operation Revenue | 693207 | 596857 | 393919 | 160070 | |

| Cost of Sale (bad debt) | -170239 | -257691 | -131522 | -53669 | |

| Other Cost of Sale | -286353 | -181295 | -135291 | -54044 | |

| Gross Revenue | 236615 | 157871 | 127106 | 52357 | 0 |

| Gross Margin | 0.3413 | 0.2645 | 0.3227 | 0.3271 | 0 |

| Overheads | -365359 | -410639 | -383780 | -98412 | 0 |

| Fixed Overheads | |||||

| Variable Overheads | |||||

| Total Operation Expense | -365359 | -410639 | -383780 | -98412 | 0 |

| Operation Profit | -128744 | -252768 | -256674 | -46055 | 0 |

| Other Revenue | -98929 | -670223 | -403441 | 48357 | |

| Interest Expense | -109411 | -30716 | -10796 | ||

| D&A | -63432 | -61529 | -91768 | -22970 | |

| Income Tax | -556 | -232 | 65240 | 648 | |

| Net Profit | -401072 | -1015468 | -697439 | -20020 | 0 |

| NOTES | 8.9b TTV; $56m impairment | $8.7bTTV; $890m impairment | $5.8bTTV; $86m impairment; $306m QuadPay; $142m share payment |

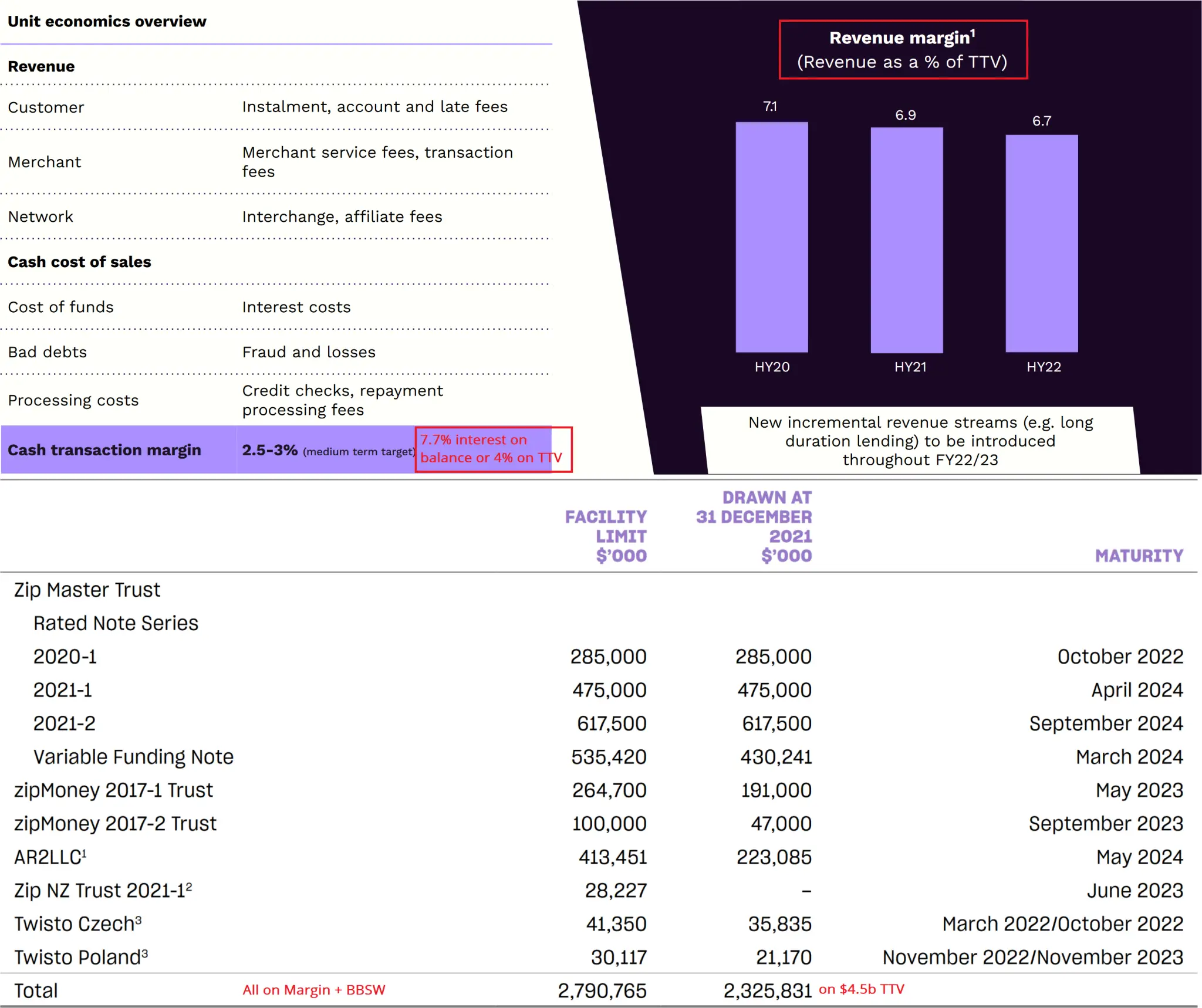

For FY21, the company charges around 6.8% p.a of TTV ($5.8b) between retailers and consumers. It pays 9.5% bank fees and interest, and 2.1% bad debt.

For FY22, the company charges around 7.1% p.a of TTV ($8.7b) between retailers and consumers. It pays 8.1% bank fees and interest, and 3.1% bad debt.

For FY23, the company charges around 7.8% p.a of TTV ($8.9b) between retailers and consumers. It pays 3.2% bank fees and interest (excluding corporate finance and warrants costs), and 1.9% bad debt.

It is unclear what is the base margin rates on the funding, but the 6-month BBSW rate is at around 3.7% (April 2023). so the long-term borrowing cost wouldn’t be any lower than 8%, so the company’s revenue model wouldn’t work at the current 7%.

SUMMARY

The smaller banks will struggle to make a profit on home mortgages from the 1.5% Net Interest Margin, I am not sure how ZIP would survive on 3% plus bad debt.