Spectur (ASX: SP3) – Australia leading solar camera

COMPANY SCOREBOARD

| Pro Plus | Pro | Con Plus | Con |

|

|

|

ABOUT COMPANY

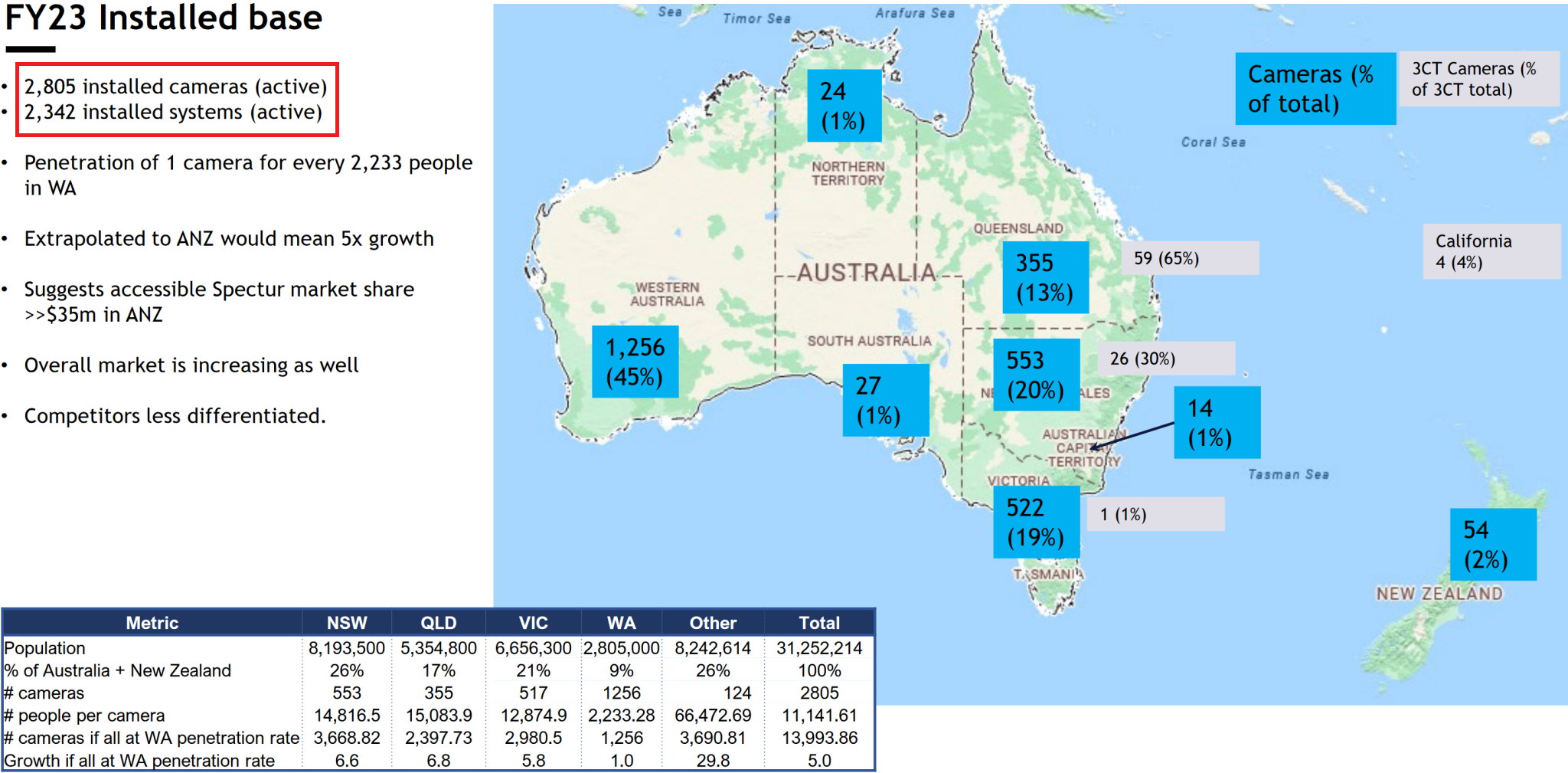

Spectur (SP3) (http://spectur.com.au/) designs, develops, manufactures, and sells remote solar cameras system and services in Australia. The company provide solutions to industries including government and utilities, and the building, construction and civil sector.

In December 2022, the company acquired 3 Crowns Technologies, a similar type of AI monitoring company with 23 customers and $1.3m ARR. The acquisition cost was $600k cash and $250k shares.

CAPITAL STRUCTURE

| ASX Code | Share Price | Shares | Option (In) | Market Cap | Cash/Asset ($m) |

| SP3 | 0.012 | 308150124 | 3697801.488 | 0/0 |

| Holders No | Top 20 (Cur) | Top 20 (Pre) | Director Hold | Performance Right | Note |

| 866 | 50.56% | 39.03% | 4.81% | 40411727 | last raise $0.9m@2c; pre raise $3m@3.6c+6.6cOpt |

The Chair and its associated EGP Capital has acquired the entire holding (prox. 5m@5.7c) from the former CEO.

In November 2024, MD Gerard Dyson resigned.

BUSINESS

Below is the company’s last five years’ performance:

| SP3 | 2024 | 2023 | 2022 | 2021 | 2020 |

| Operation Revenue | 8186 | 7368 | 5828 | 5249 | 4802 |

| Cost of Sale | -3661 | -3219 | -2625 | -2109 | -1728 |

| Gross Revenue | 4525 | 4149 | 3203 | 3140 | 3074 |

| Gross Margin | 0.5528 | 0.5631 | 0.5496 | 0.5982 | 0.6401 |

| Overheads | -6657 | -6537 | -5063 | -5273 | -4740 |

| Fixed Overheads | |||||

| Variable Overheads | |||||

| Total Operation Expense | -6657 | -6537 | -5063 | -5273 | -4740 |

| Operation Profit | -2132 | -2388 | -1860 | -2133 | -1666 |

| Other Revenue | -546 | -415 | 380 | 215 | |

| Interest Expense | -158 | -127 | -88 | -15 | -9 |

| D&A | -239 | -314 | -321 | -317 | -393 |

| Income Tax | 494 | 323 | 360 | 330 | 231 |

| Net Profit | -2581 | -2921 | -1529 | -1755 | -1622 |

| NOTES | 560k inventory write off | 435k impairment | 536k restructure |

The company’s products have relevance in today’s environment. However, it requires $8m to run the business, and there isn’t any recurring revenue in the pricing that rewards the scale of the business other than data consumption and field works.

Given the company has already possessed a fair market share in WA, and it still loses $2m a year, that means the pricing model isn’t right.

SUMMARY

All directors take shares as the directors fees.