Resonance Health (ASX: RHT) – non-invasive liver diagnostic

ABOUT COMPANY

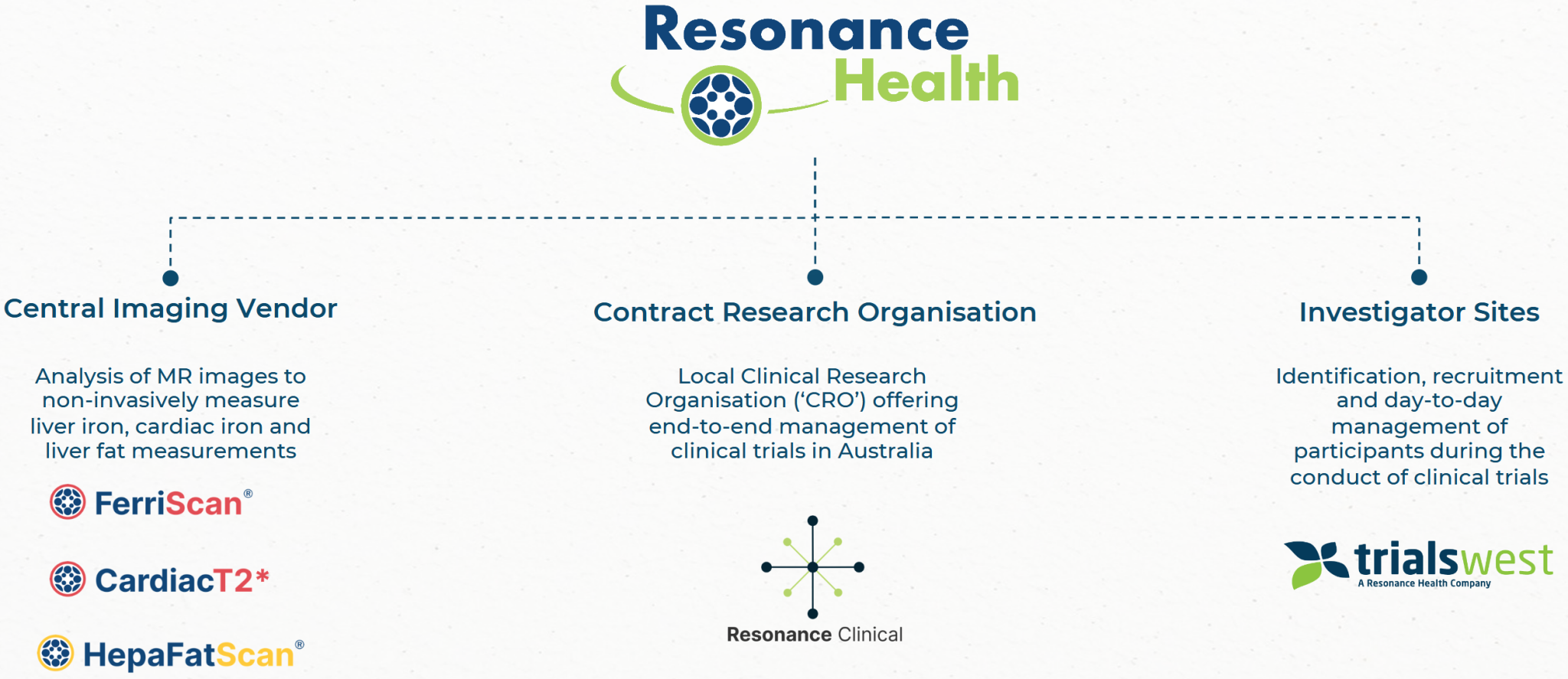

Resonance Health (RHT) (http://www.resonancehealth.com/) develops and delivers non-invasive medical imaging software and services worldwide. The company’s products are used by clinicians in the diagnosis and management of human diseases and by pharmaceutical companies in their clinical trials for the measurement of liver iron and liver fat. Its flagship products include FerriScan®, FerriSmart®, HepaFat-Scan®, and the recently developed HepaFat-AI and Alert-PE.

In Feb 2024, the company acquired TrialsWest for $4m upfront and $4m earn-out (payable if EBITDA over $1.33m annually to FY26).

CAPITAL STRUCTURE

| ASX Code | Share Price | Shares | Option (In) | Market Cap | Cash/Asset ($m) |

| RHT | 0.041 | 459616138 | 18844261.658 | 5.8/0 |

| Holders No | Top 20 (Cur) | Top 20 (Pre) | Director Hold | Performance Right | Note |

| 1809 | 47.97% | 49.94% | 20.09% | 4776676 |

Both CEO and CFO resigned in April 2021, and the share price started its down trend thereafter. The next CEO resigned in June 2023.

The current CEO, Andrew Harrison, founded and was MD of CAJ.

BUSINESS

Below is the company’s past five years performance:

| RHT | 2024 | 2023 | 2022 | 2021 | 2020 |

| Operation Revenue | 8589 | 4404 | 3828 | 3779 | 3668 |

| Cost of Sale | |||||

| Gross Revenue | 8589 | 4404 | 3828 | 3779 | 3668 |

| Gross Margin | 1 | 1 | 1 | 1 | 1 |

| Overheads | -8932 | -5593 | -5171 | -3315 | -4511 |

| Fixed Overheads | |||||

| Variable Overheads | |||||

| Total Operation Expense | -8932 | -5593 | -5171 | -3315 | -4511 |

| Operation Profit | -343 | -1189 | -1343 | 464 | -843 |

| Other Revenue | 214 | 361 | 220 | 207 | 190 |

| Interest Expense | 37 | 41 | |||

| D&A | -498 | -436 | -429 | -364 | -341 |

| Income Tax | 796 | 484 | 410 | 242 | 238 |

| Net Profit | 169 | -780 | -1142 | 586 | -715 |

| NOTES | 827k share payment, $1.5m additional consult | $1.8m share payment |

SUMMARY

The company will be making money again in 2025.