Lunnon Metals (ASX: LM8) – Kambalda Nickel Project

ABOUT COMPANY

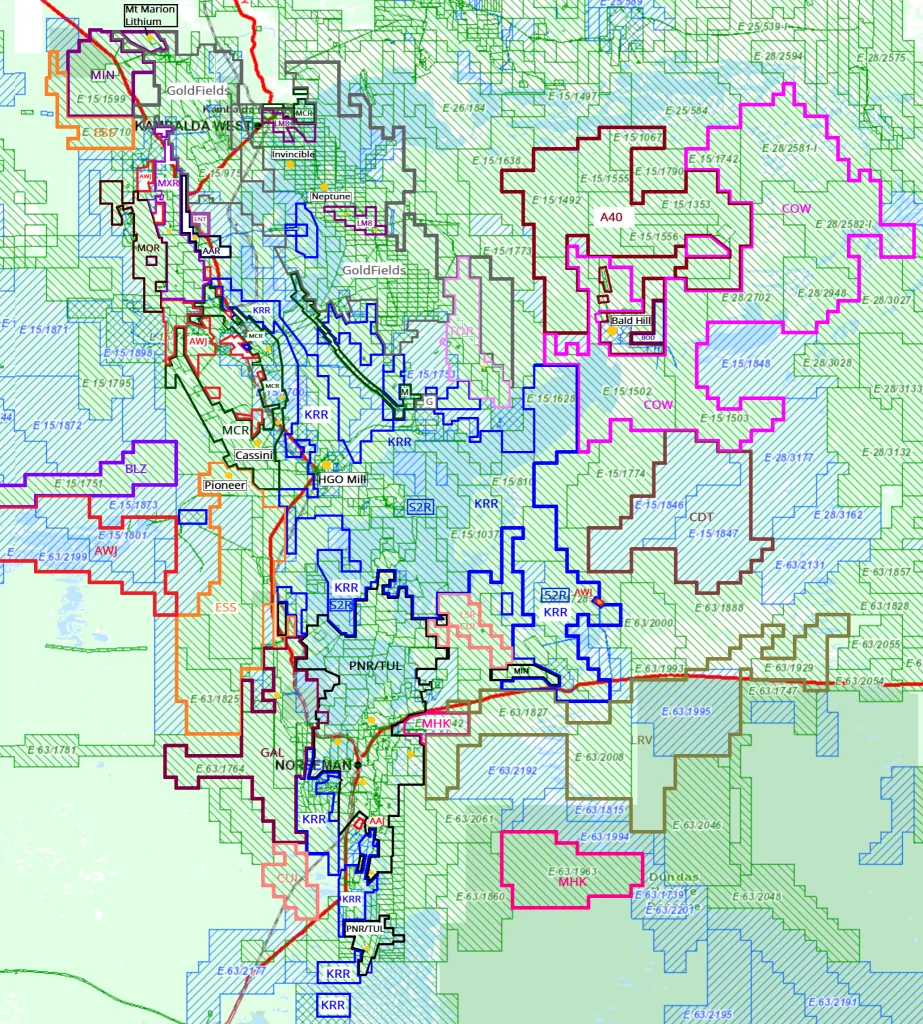

Lunnon Metals (LM8) (https://lunnonmetals.com.au/) explores and develops nickel assets in the Kambalda region WA.

The company was listed in June 2021 by raising $15m@30c. At the time, it has spent $6m on direct exploration expenditure (or 12c per share) since 2014.

In April 2022, the company acquired further tenements from Goldfield for $20m worth of shares at 93c.

CAPITAL STRUCTURE

| ASX Code | Share Price | Shares | Option (In) | Market Cap | Cash/Asset ($m) |

| LM8 | 0.225 | 220628174 | 49641339.15 | 19/0 |

| Holders No | Top 20 (Cur) | Top 20 (Pre) | Director Hold | Performance Right | Note |

| 1225 | 69.11% | 72.76% | 6.95% | 10442640 | last raise $18m@90c |

Goldfield holds 67m (30.5%) shares.

FLAGSHIP ASSETS

Kambalda Nickel Project WA

Project Data

Its old mines require de-water for access.

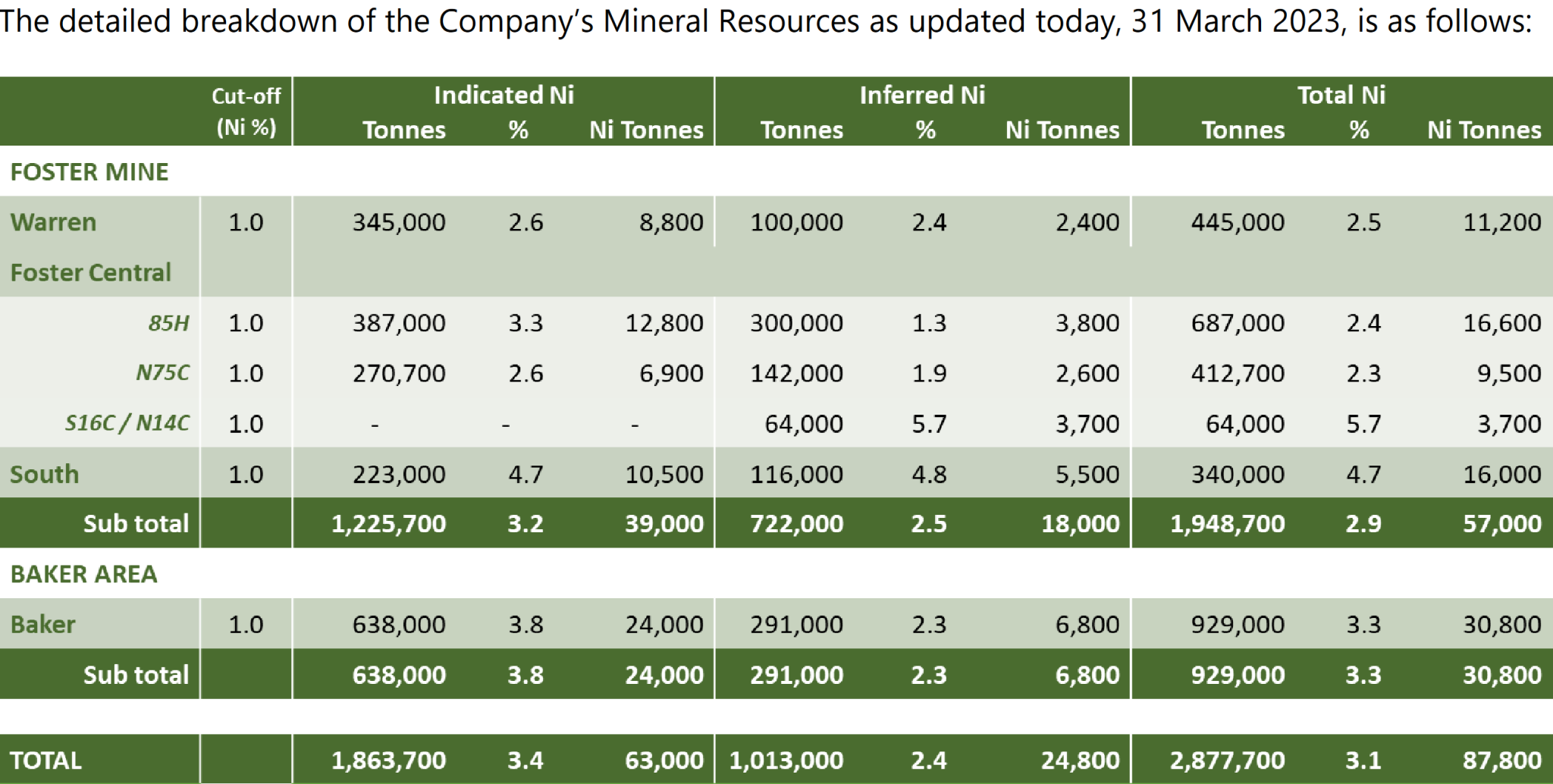

Its resource is perhaps worth some $800 per tonne, not $2,000.

The economic study on the Baker deposit indicated some $100m cash flow return, which mean, the current resources worth no more than $200-$250m.

Below are the project’s resources:

SUMMARY

MCR’s $1b market cap status might be achievable, thus, Goldfield took all the shares.