Great Boulder Resources (ASX: GBR) – two Zebina Mineral JV

COMPANY SCOREBOARD

| Pro Plus | Pro | Con Plus | Con |

|

|

|

|

ABOUT COMPANY

Great Boulder Resources (GBR) (https://www.greatboulder.com.au/) explores gold in Australia. Its flagship project is the Side Well gold project in Meekathara WA.

CAPITAL STRUCTURE

| ASX Code | Share Price | Shares | Option (In) | Market Cap | Cash/Asset ($m) |

| GBR | 0.074 | 759100334 | 56173424.716 | 5.2/0 |

| Holders No | Top 20 (Cur) | Top 20 (Pre) | Director Hold | Performance Right | Note |

| 2921 | 30.56% | 33.32% | 1.75% | 15000000 | last raise $6.3m@4.2c; pre raise $4.5m@5c |

Zebina Minerals (Scott Wilson) is the third largest shareholder, and holds a 25% interests on two projects. The largest holder, Retzos Group, is the KFC owner.

It holds 25m CMO shares@17c worth $4.25m (check again).

Most performance rights are linked to the underlying share price (20c) and resources delineation (750k oz plus).

FLAGSHIP ASSETS

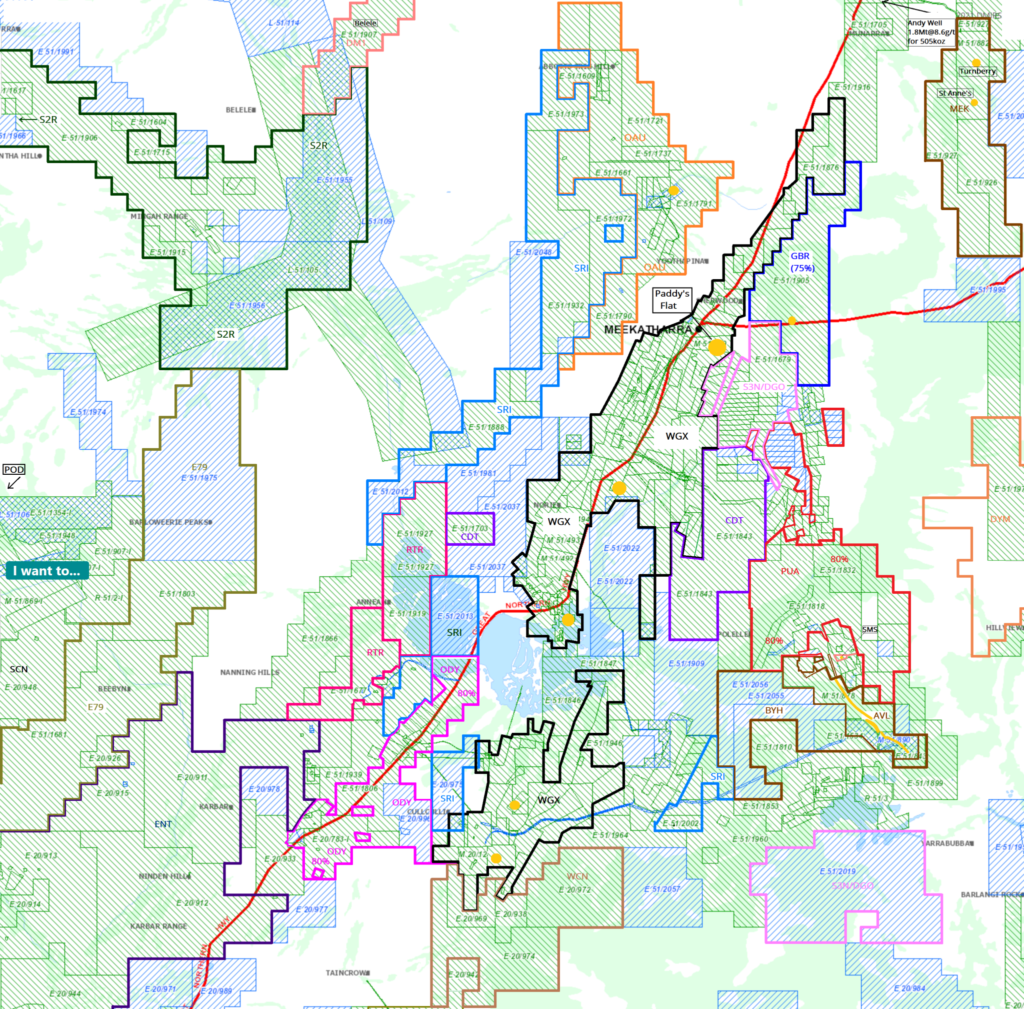

Side Well Gold Copper Project Meekathara WA (75%, 132 km2)

Project Data

In July 2020, the company entered the option to acquire 75% of the project from Zebina Minerals by July 2022 for a total consideration of $550k. Zebina’s 25% interest will remain free–carried to a decision to mine. It will also retain ownership of all surface gold rights.

The company drilled 731 holes for nearly 59k metres in FY22. Some drilling results are exceptional. However,the ground is deeply weathered with leached soils and a layer of transported cover, and the top of the fresh rock is 100m below the surface.

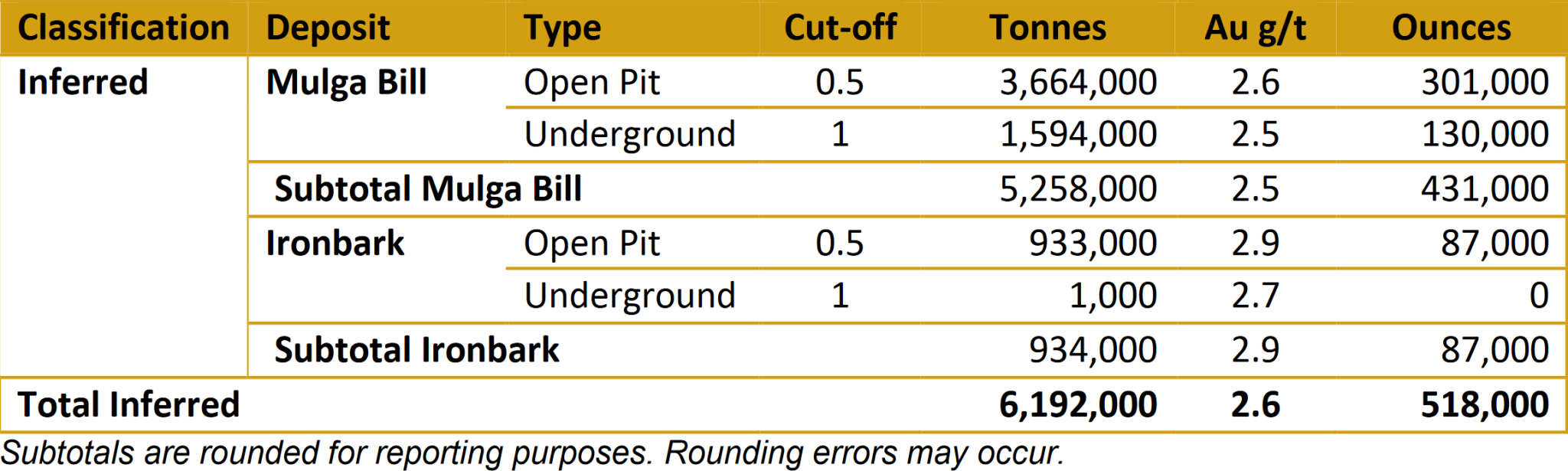

Below is the project’s resources defined in 2023 (on 100% basis):

OTHER ASSETS

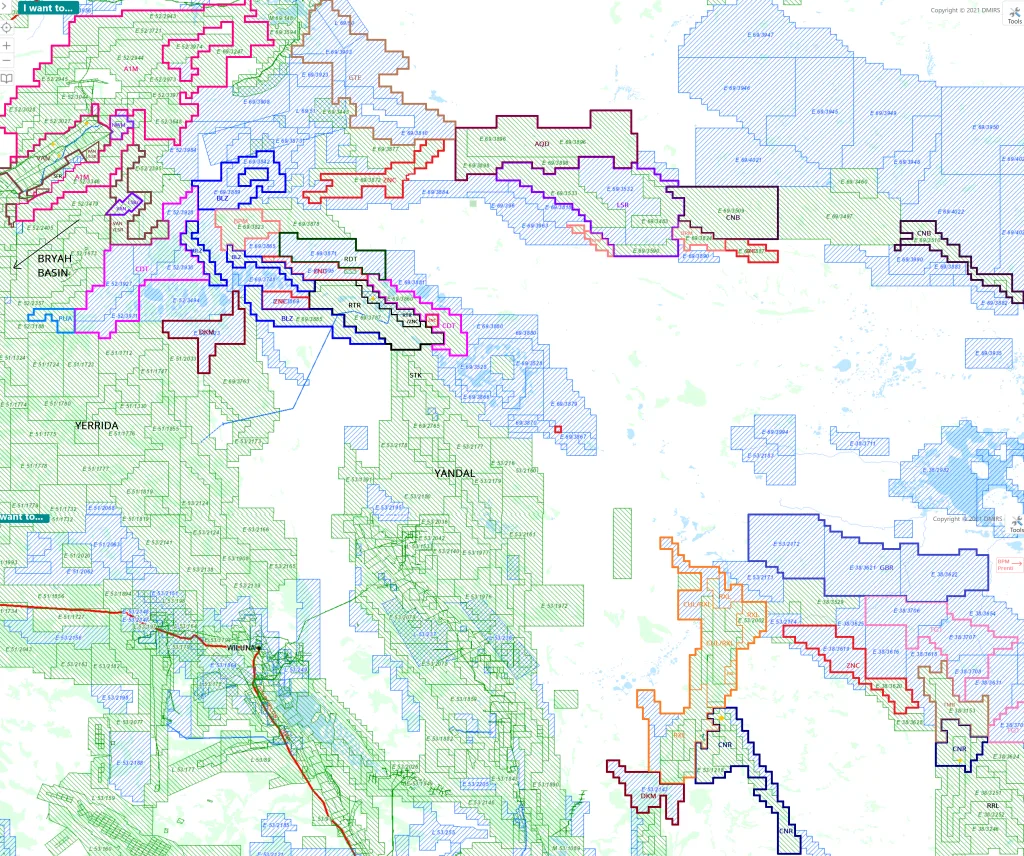

Whiteheads Gold/ Nickel Project Kalgoorlie WA (75%, 230 km2)

The company entered the option to acquire 75% of the project from Zebina Minerals in August 2019.

The 79 holes AC program results in April 2022 are below average.

SUMMARY

At the Side Well project, if Zebina entitles to all surface gold, and 25% free-carry, I don’t think there is anything left for the company.