Delta Lithium (ASX: DLI) – develop two WA lithium project

COMPANY SCOREBOARD

| Pro Plus | Pro | Con Plus | Con |

|

|

|

ABOUT COMPANY

Delta lithium (DLI) (https://deltalithium.com.au/) explores lithium and gold in Western Australia. Its flagship is the Mt Ida Lithium Gold Project.

CAPITAL STRUCTURE

| ASX Code | Share Price | Shares | Option (In) | Market Cap | Cash/Asset ($m) |

| DLI | 0.165 | 716541792 | 118229395.68 | 70/0 |

| Holders No | Top 20 (Cur) | Top 20 (Pre) | Director Hold | Performance Right | Note |

| 7376 | 70.09% | 64.07% | 1.52% | 14797500 | last raise $70m@46c; pre raise $46.4m@70.75c |

MIN owns 23% of the company, and 2 directors are on the board; Hancock holds 10.7%. Both acquired shares at the major cap raise at 46c.

FLAGSHIP ASSETS

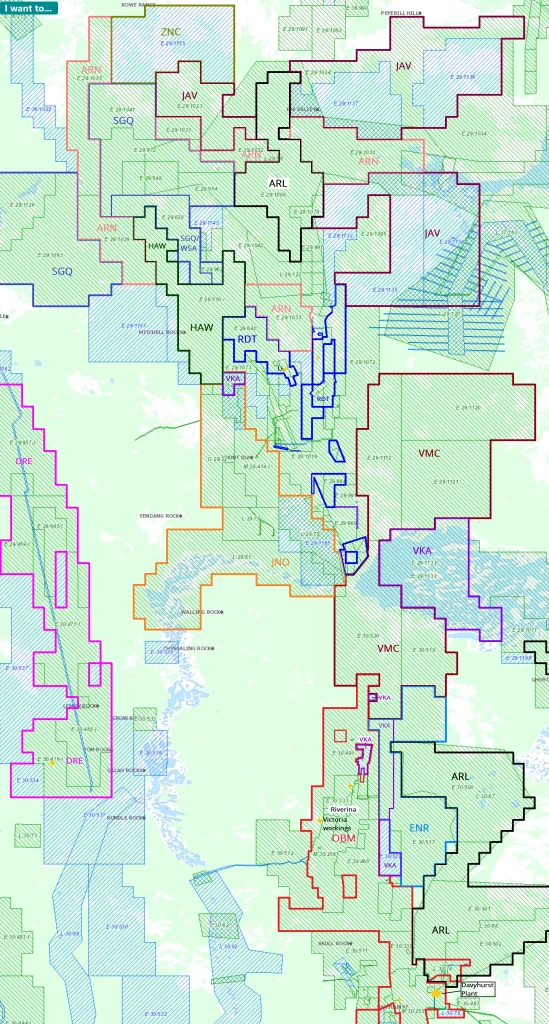

Mt Ida Lithium Gold Project WA

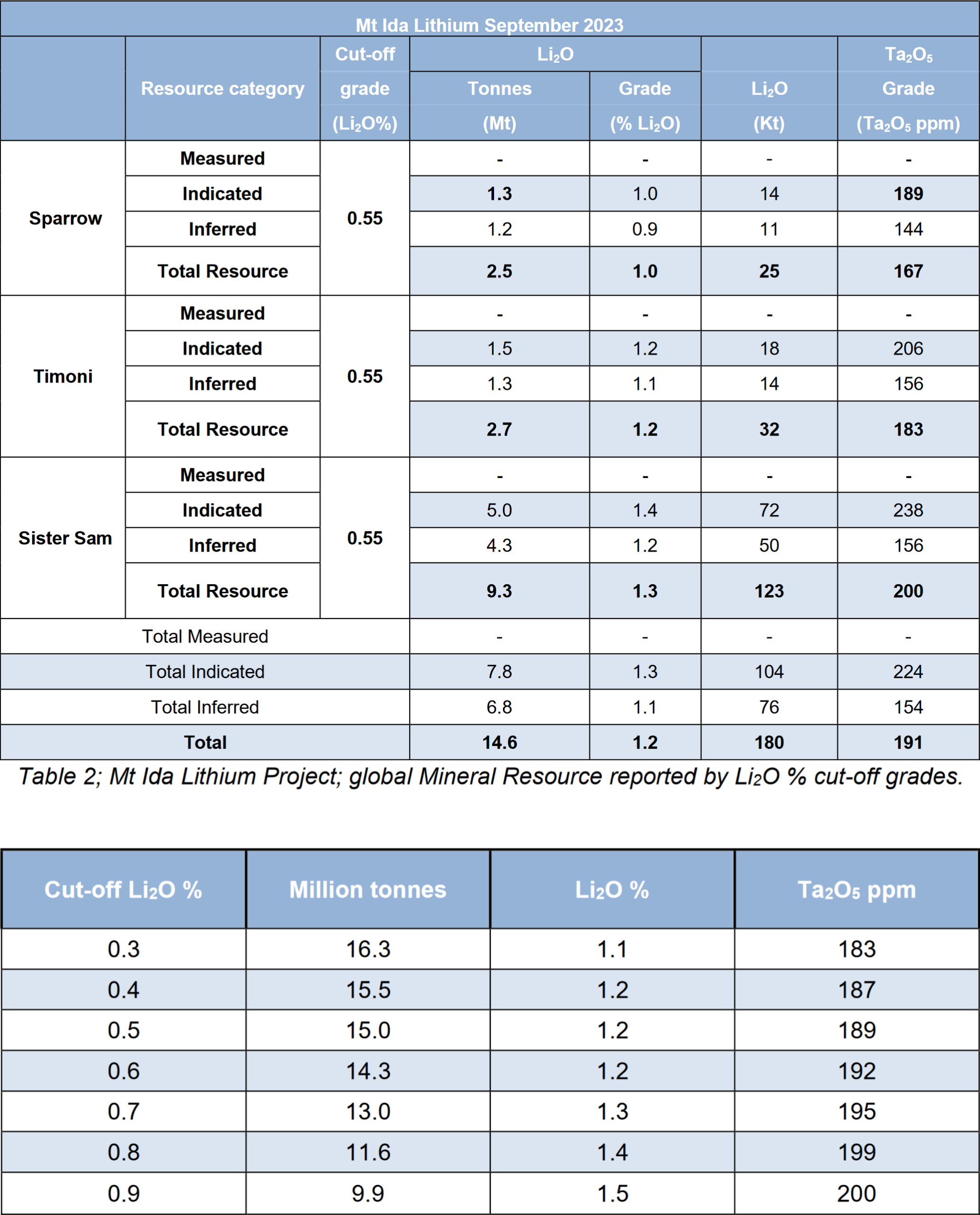

Below are the project’s resources:

The 2023 update estimated the resource of 9.9Mt@1.5% at 0.9% cut-off for 148,500

OTHER ASSETS

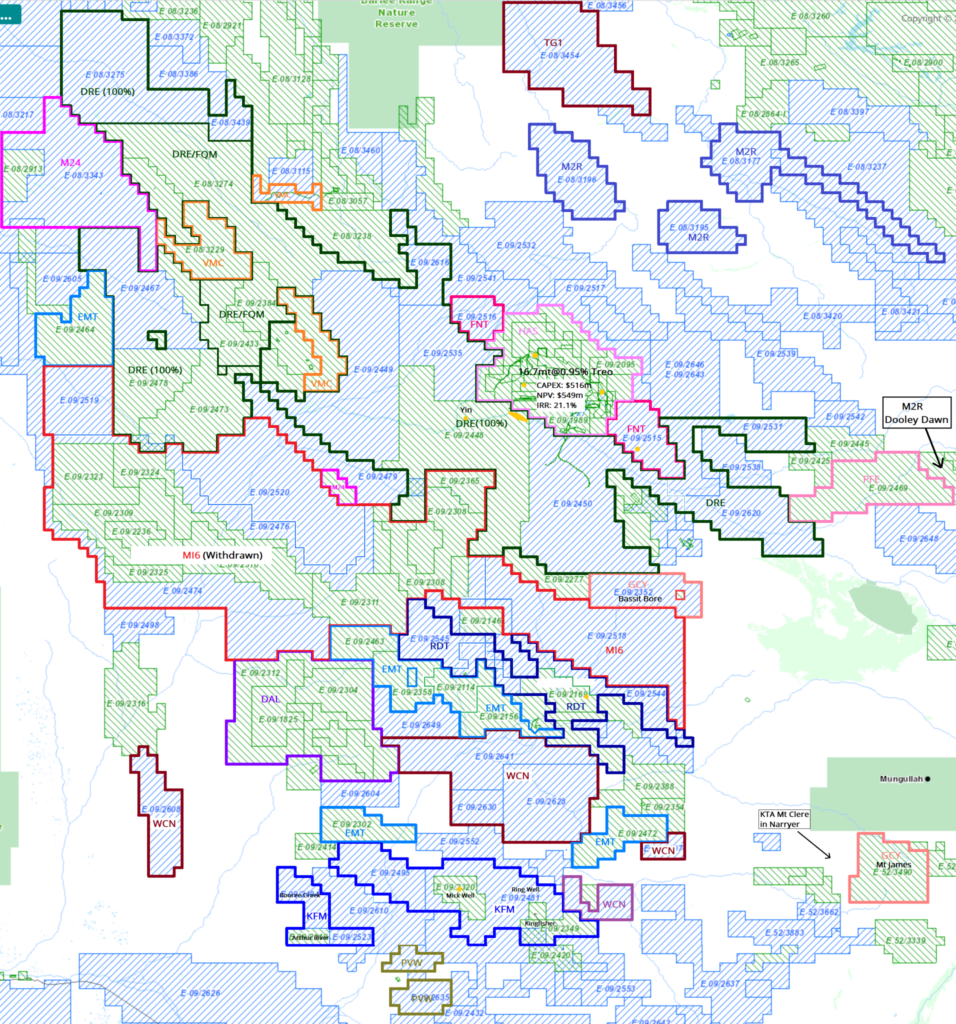

Yinnetharra Lithium Project Gascoyne

The company acquired the project in September 2022 for $15m shares@56.7c and an additional milestone payment of $10m shares@VWAP upon delineation of 15m@0.9% Li2O within 4 years (ACHIEVED) from a 100% owned subsidiary of Toronto based Waratah Capital Advisers (a Chinese backed entity).

In Dec 2023, the company reported a resource estimate of 14.4m@1.1% for 158,400 Li.

SUMMARY

You wonder why OBM sold the gold project in 2021 in the first place.