Aroa Biosurgery (ASX: ARX) – soft-tissue regeneration

COMPANY SCOREBOARD

| Pro Plus | Pro | Con Plus | Con |

|

|

|

ABOUT COMPANY

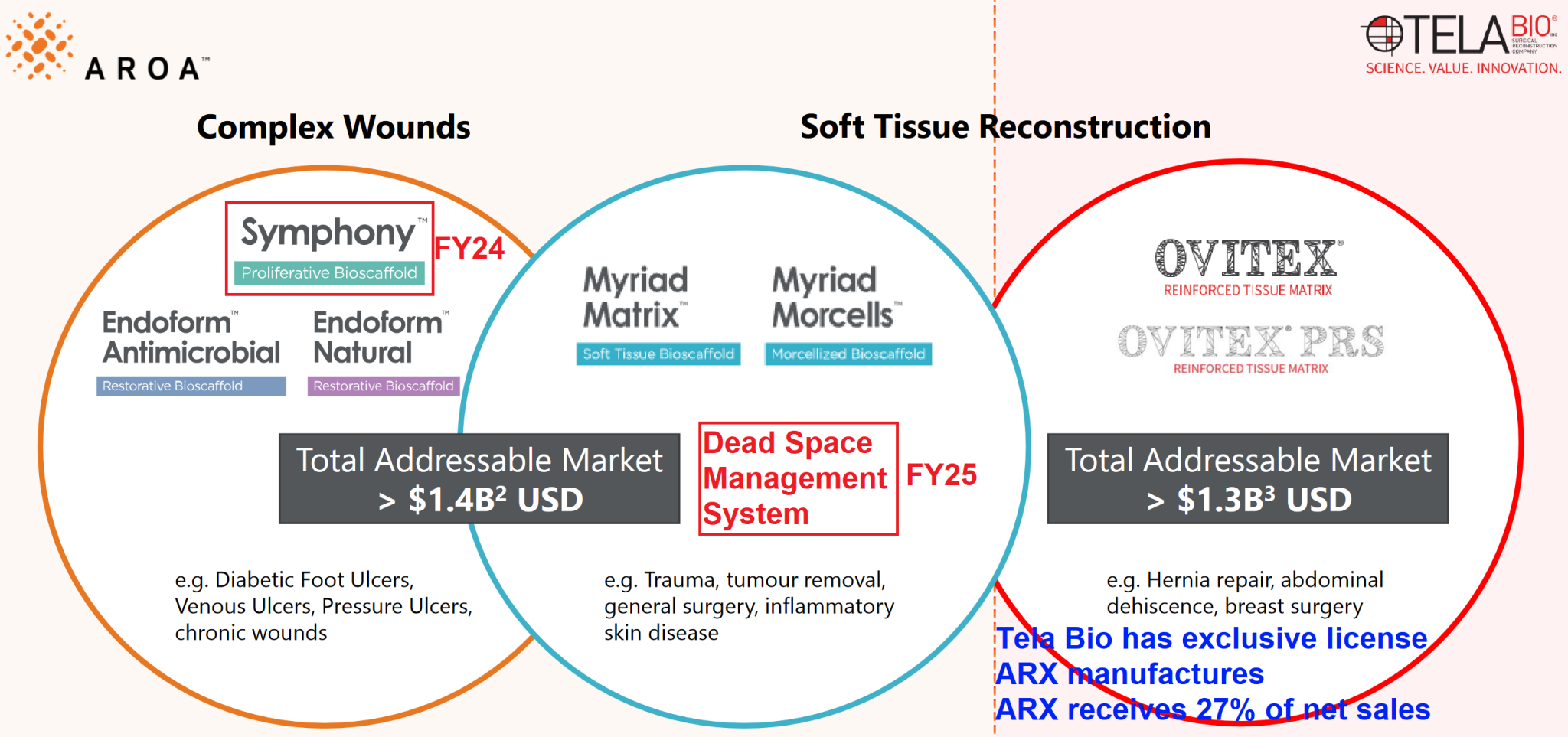

Aroa Biosurgery (ARX) (https://aroa.com/) is a soft-tissue regeneration company in NZ that develops, manufactures, and distributes medical and surgical products to improve healing in complex wounds and soft tissue reconstruction

CAPITAL STRUCTURE

| ASX Code | Share Price | Shares | Option (In) | Market Cap | Cash/Asset ($m) |

| ARX | 0.51 | 344900256 | 5438963 | 178673001.69 | 34/72 |

| Holders No | Top 20 (Cur) | Top 20 (Pre) | Director Hold | Performance Right | Note |

| 3704 | 72.40% | 76.21% | 16.98% | 3969127 |

Several institutions have quietly built some stakes.

BUSINESS

Below is the company’s five years performance:

| ARX | 2024 | 2023 | 2022 | 2021 | 2020 |

| Operation Revenue | 69066 | 63360 | 39680 | 22342 | |

| Cost of Sale | -10093 | -9884 | -9377 | -6818 | |

| Gross Revenue | 58973 | 53476 | 30303 | 15524 | 0 |

| Gross Margin | 0.8539 | 0.8440 | 0.7637 | 0.6948 | 0 |

| Overheads | -71308 | -58321 | -39062 | -28184 | |

| Fixed Overheads | |||||

| Variable Overheads | |||||

| Total Operation Expense | -71308 | -58321 | -39062 | -28184 | 0 |

| Operation Profit | -12335 | -4845 | -8759 | -12660 | 0 |

| Other Revenue | 1943 | 427 | 386 | -4384 | |

| Interest Expense | 244 | 2727 | -618 | -1111 | |

| D&A | |||||

| Income Tax | -201 | -12 | -125 | -107 | |

| Net Profit | -10349 | -1703 | -9116 | -18262 | 0 |

| NOTES | Revenue all in USA |

Tela Bio partnership makes half of the sales.

SUMMARY

The company will be a good defensive stock to hold if the market comes down in CY25. 50c W bottom seems solid.