Alpha HPA (ASX: A4N) – HPA extraction and refining technology

COMPANY SCOREBOARD

| Pro Plus | Pro | Con Plus | Con |

|

|

ABOUT COMPANY

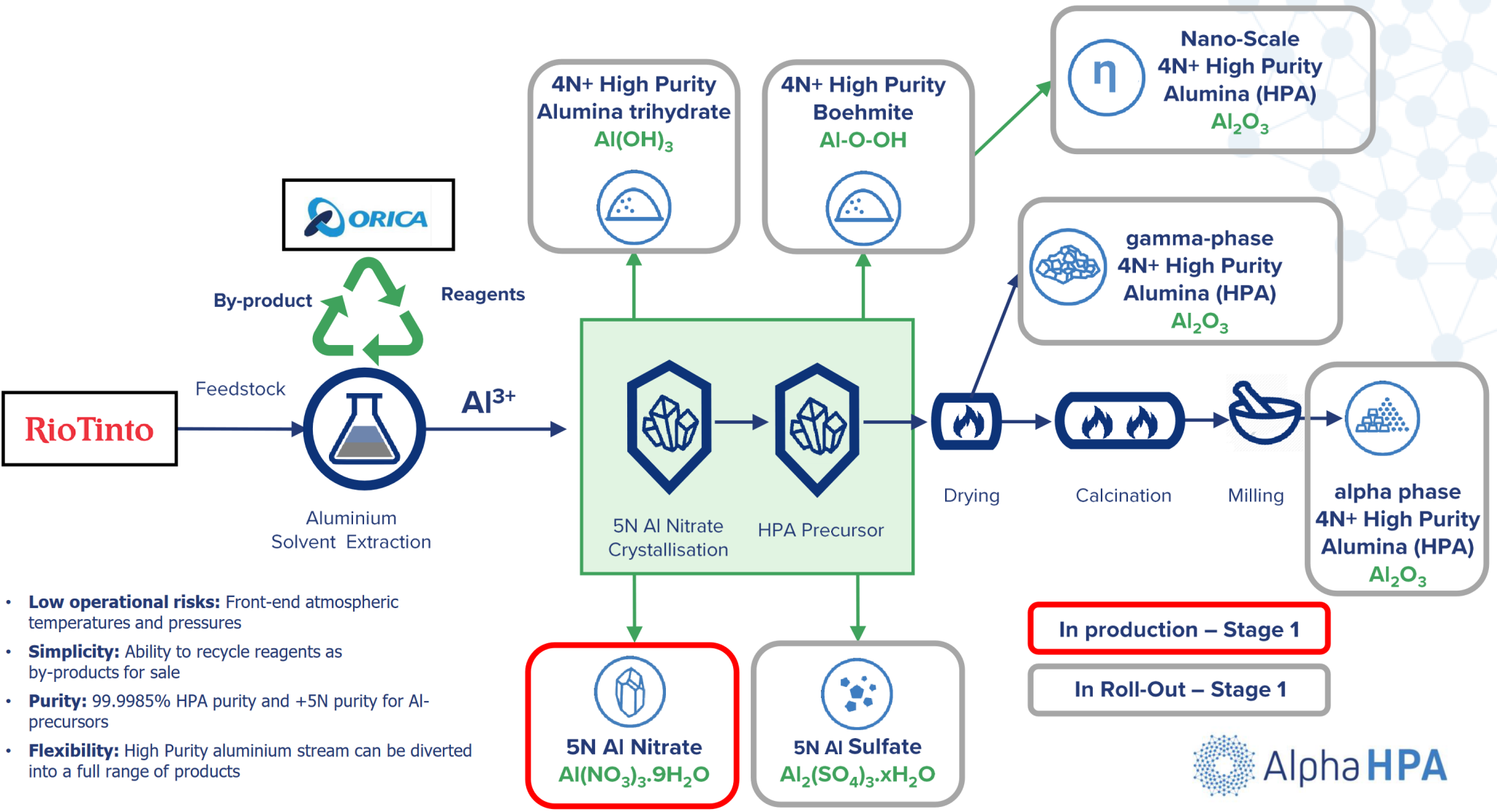

Alpha HPA (A4N) (https://alphahpa.com.au/) commercialises its proprietary solvent extraction and refining technology to produce High Purity Alumina (HPA) through the delivery of its HPA First Project within the Gladstone State Development Area in Queensland, Australia.

CAPITAL STRUCTURE

| ASX Code | Share Price | Shares | Option (In) | Market Cap | Cash/Asset ($m) |

| A4N | 1.03 | 933799090 | 961813062.7 | 45/0 |

| Holders No | Top 20 (Cur) | Top 20 (Pre) | Director Hold | Performance Right | Note |

| 4329 | 58.25% | 53.99% | 14.44% | last raise $40m@73c |

Orica holds 45m (5%) at 44c.

Directors started offloading shares at $1.

COMPANY ASSETS

HPA First Project QLD

The company completed its DFS in March 2020 based on an annual production of 10kt. It will receive commonwealth government grants of $15.5m for Stage 1 and $45m for Stage 2, plus $21.7m from QLD government for Stage 2 (over 6 milestones including payment of $367.5m project expenditure and employing 151 full time staff).

Other project funding includes $30m from a critical mineral venture fund, and the repayment is based on net-sale, instead of interest rate.

The project is in stage 1 ramp-up, as at March 2023, the daily capacity is at sub 5% compared with DFS. However, neither unit revenue nor unit cost is clear at this stage.

SUMMARY

Based on its order book, it will take a long time to reach 10kt a year.