Chrysos Corporation (ASX: C79) – gold assay analysis

ABOUT COMPANY

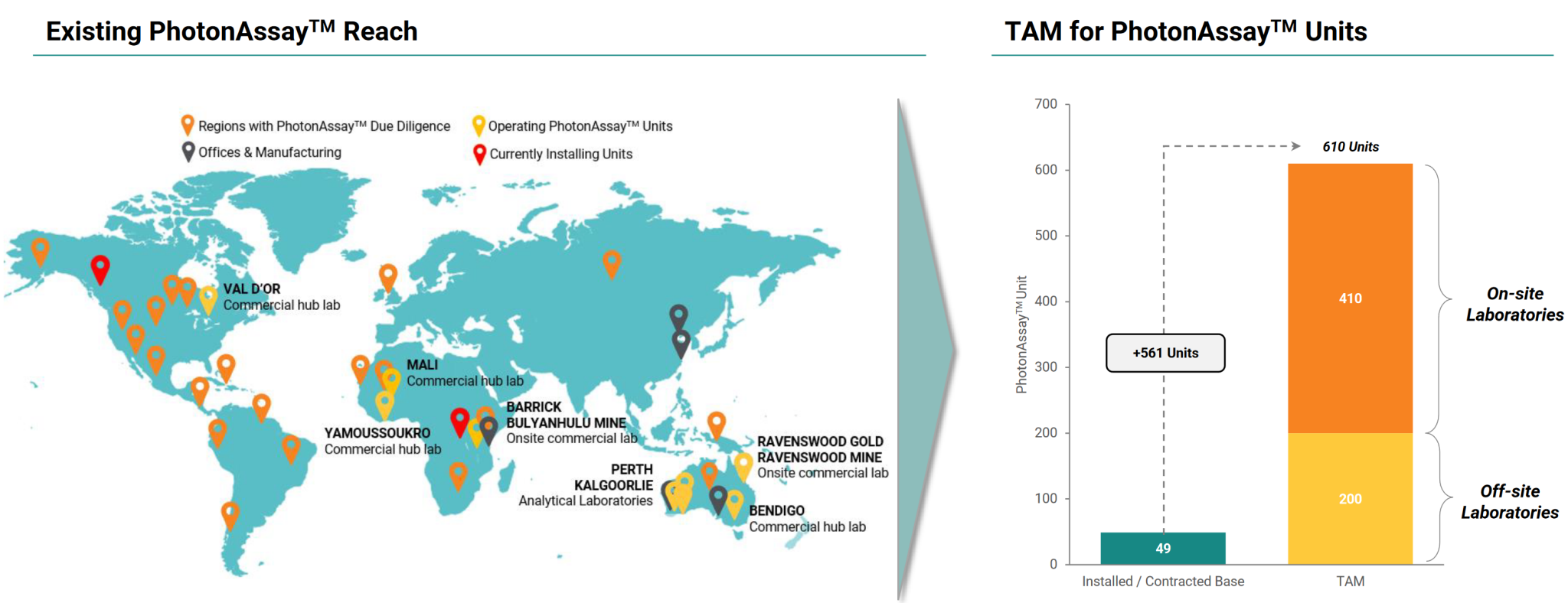

Chrysos Corporation (C79) (https://chrysoscorp.com/) delivers faster, safer, and more accurate gold analysis through its flagship product Chrysos PhotonAssay™. The technology and its market advantages are validated through its adoption by three of the four largest operators of

geochemistry laboratories globally.

The company was listed in May 2022 by raising a net of $65m@$6.5 (new issue of 10m shares + 18.2m outgoing existing shareholders)

CAPITAL STRUCTURE

| ASX Code | Share Price | Shares | Option (In) | Market Cap | Cash/Asset ($m) |

| C79 | 7.07 | 114823797 | 4107378 | 840843407.25 | 73.8/193 |

| Holders No | Top 20 (Cur) | Top 20 (Pre) | Director Hold | Performance Right | Note |

| 1696 | 83.4% | 79.90% | 9.18% | 1110070 | last raise $75m@$6.6 |

The company has a $30m loan from CBA for the production PhotonAssay unit, the interest cost is unknown.

BUSINESS

Below is the company’s five years performance:

| C79 | 2023 | 2022 | 2021 | 2020 | 2019 |

| Operation Revenue | 25613 | 13521 | 4388 | ||

| Cost of Sale | |||||

| Gross Revenue | 25613 | 13521 | 4388 | 0 | 0 |

| Gross Margin | 1 | 1 | 1 | 0 | 0 |

| Overheads | -23317 | -14836 | -5561 | ||

| Fixed Overheads | |||||

| Variable Overheads | |||||

| Total Operation Expense | -23317 | -14836 | -5561 | 0 | 0 |

| Operation Profit | 2296 | -1315 | -1173 | 0 | 0 |

| Other Revenue | 2795 | 737 | 142 | ||

| Interest Expense | -792 | -1905 | -468 | ||

| D&A | -6421 | -2825 | -2343 | ||

| Income Tax | 2565 | 1370 | |||

| Net Profit | 443 | -3938 | -3842 | 0 | 0 |

| NOTES |

The company makes about $120k Minimum Monthly Assay Payments (MMAP) for every deployed unit, plus additional 20% Additional Assay Charges (AAC). Each unit costs around $5m to build.

As of December 2023, the company has deployed 24 units, 4 more from June 23. All extra revenue was eaten by D&A and staff cost.

SUMMARY

If each unit costs $5m to build, the rate of ROA wouldn’t be very high. Nevertheless, the company might be a better bet than the actual gold companies if the gold price sustains.