Cooper Energy (ASX: COE) – Southeast Australia gas play

ABOUT COMPANY

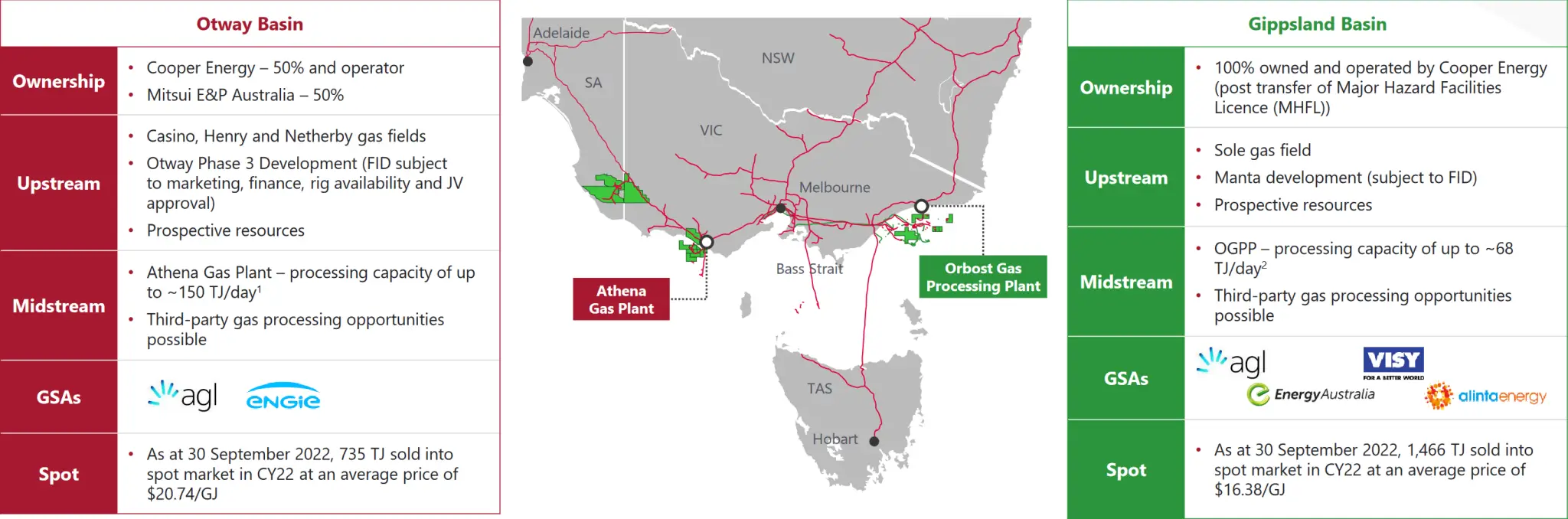

Cooper Energy (COE) (https://www.cooperenergy.com.au/) provides gas supply to southeast Australia. The company has a portfolio comprising prospective acreage in the Cooper, Otway, and Gippsland basins in Australia.

In June 2022, the company re-acquired the Orbost Gas Processing Plant from the APA Group. The full acquisition cost will be between $270 million and $330 million. The plant has demonstrated an ability to deliver processing at average rates of around 55 TJ/day. The transaction transforms the company into a vertically integrated gas producer, processor, and supplier.

CAPITAL STRUCTURE

| ASX Code | Share Price | Shares | Option (In) | Market Cap | Cash/Asset ($m) |

| COE | 0.215 | 2628686936 | 565167691.24 | 47.8/439 |

| Holders No | Top 20 (Cur) | Top 20 (Pre) | Director Hold | Performance Right | Note |

| 9339 | 77.78% | 1.33% | last raise $244m@24.5c |

$60m deferred payment plus up to $60m deferred performance payment for the acquisition of the Orbost Gas Processing Plant.

The company pays 9.3% floating rate on $300m plus debt due Sep 2027.

COMPANY ASSETS

Below is the company’s five years performance

| COE | 2023 | 2022 | 2021 | 2020 | 2019 |

| Operation Revenue | 196885 | 205389 | 131734 | ||

| Cost of Sale | -68872 | -106634 | -76859 | ||

| Gross Revenue | 128013 | 98755 | 54875 | 0 | 0 |

| Gross Margin | 0.6502 | 0.4808 | 0.4166 | 0 | 0 |

| Overheads | -107405 | -53819 | -38563 | ||

| Fixed Overheads | |||||

| Variable Overheads | |||||

| Total Operation Expense | -107405 | -53819 | -38563 | 0 | 0 |

| Operation Profit | 20608 | 44936 | 16312 | 0 | 0 |

| Other Revenue | 648 | -332 | 7869 | ||

| Interest Expense | -26477 | -13631 | -13512 | ||

| D&A | -98824 | -54032 | -43452 | ||

| Income Tax | 36230 | 12169 | 3434 | ||

| Net Profit | -67815 | -10890 | -29349 | 0 | 0 |

| NOTES | production volume 3.56 MMboe | 19m restoration expense; sales volume 3.83 MMboe |

The company makes about $25m cash flow from 3.83 MMboe sales.

Since the company acquired OGPP, it will need to expense an additional $35m D&A a year. At the moment, no efficiency has been gained.

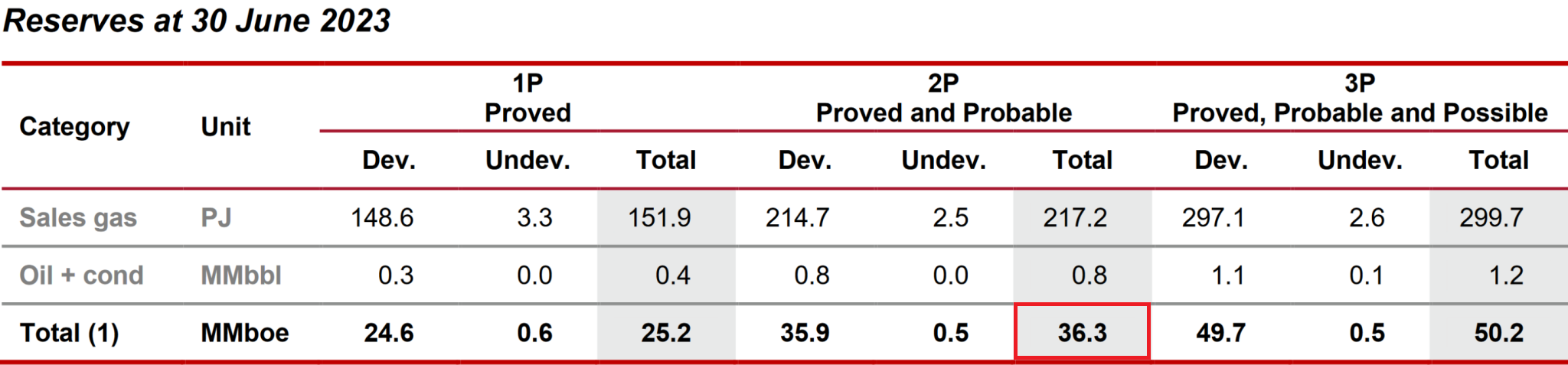

Below are the company’s reserves:

SUMMARY

The company’s 2P reserves are perhaps worth around $300m.