Regis Resources (ASX: RRL) – ownership of Albany Fraser Belt

COMPANY SCOREBOARD

| Pro Plus | Pro | Con Plus | Con |

|

|

|

ABOUT COMPANY

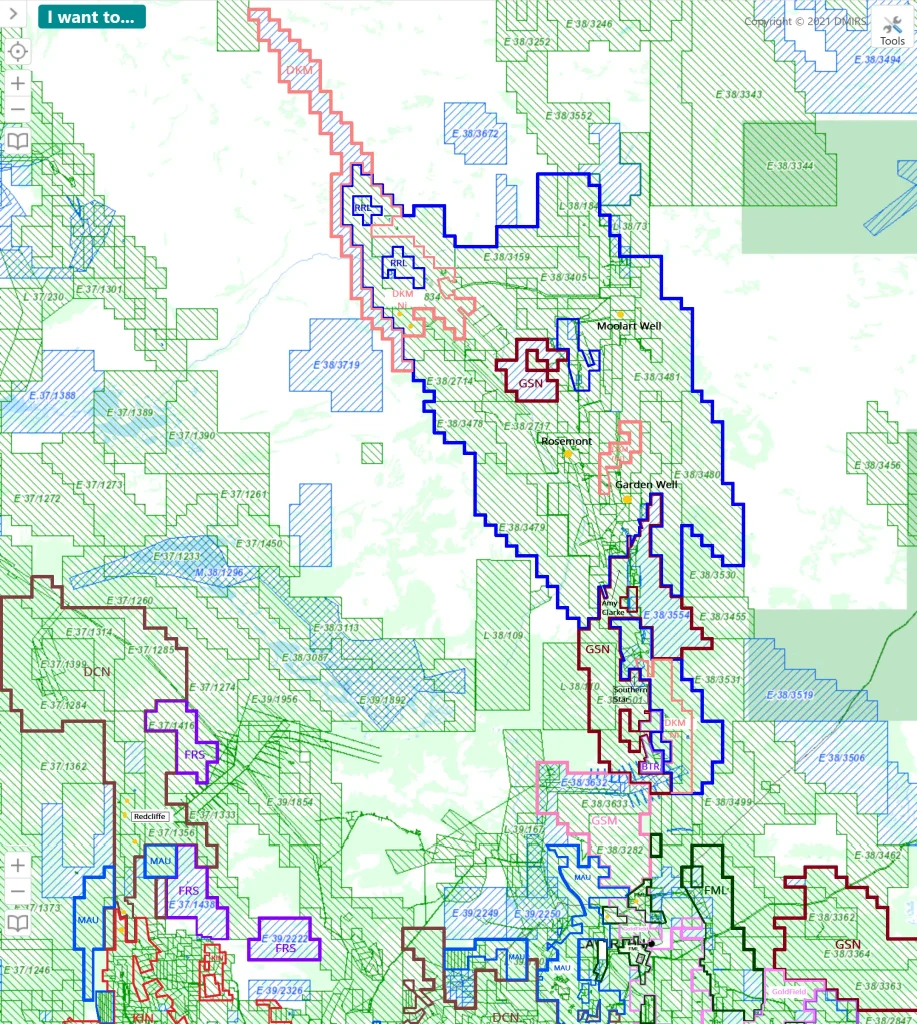

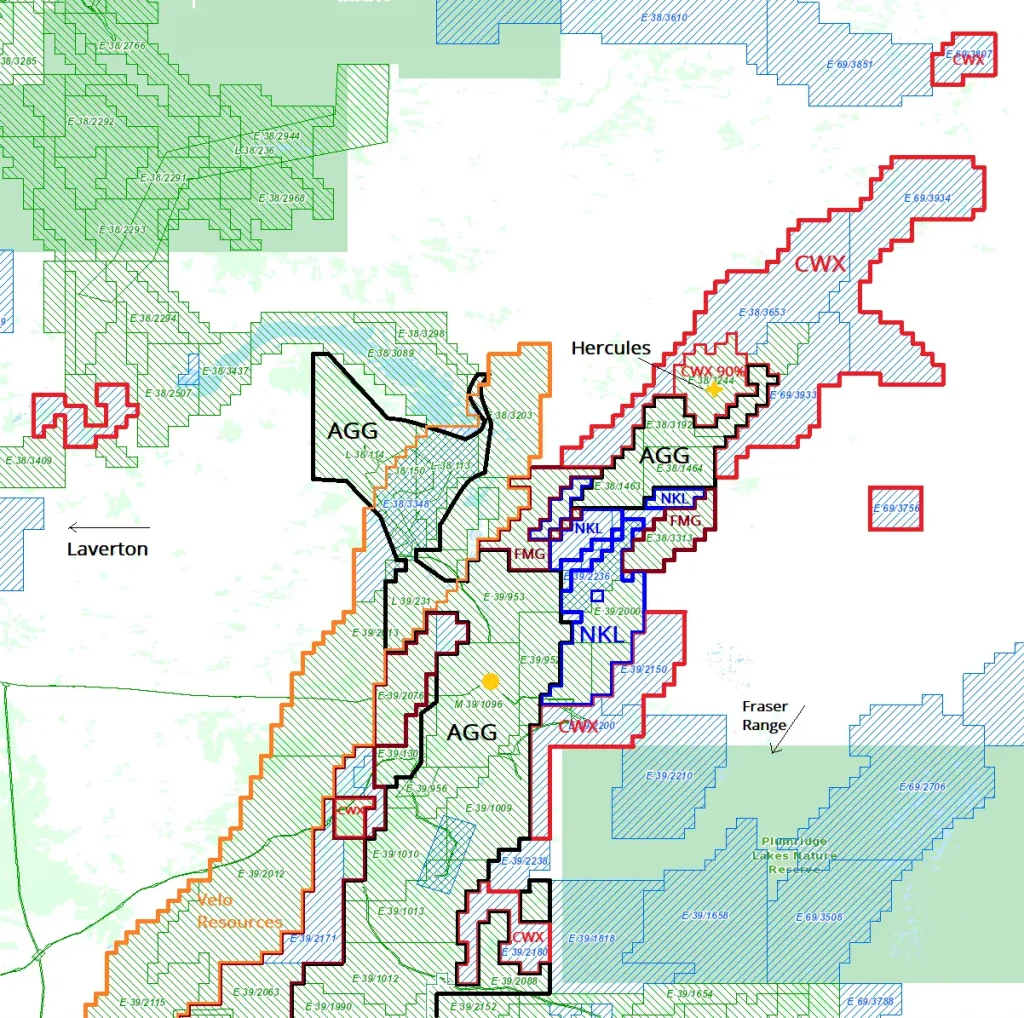

Regis Resources (RRL) (https://regisresources.com.au/) develops the Duketon Gold Project in the Eastern Goldfields of WA. It also owns a 30% interest in the Tropicana Gold Project. Additionally, the company owns the McPhillamys Gold Project in NSW which has been in licensing stage.

In 2021, the company purchased the 30% stake in the Tropicana Gold Mine from IGO for $903m.

CAPITAL STRUCTURE

| ASX Code | Share Price | Shares | Option (In) | Market Cap | Cash/Asset ($m) |

| RRL | 2.21 | 755338808 | 1669298765.68 | 30/(298) |

| Holders No | Top 20 (Cur) | Top 20 (Pre) | Director Hold | Performance Right | Note |

| 21944 | 71.29% | 68.59% | 0.15% | 988895 |

The company borrowed $300m@BBSY+2% for Tropicana purchase due June 2025, but McPhillamys DFS is delayed.

FLAGSHIP ASSETS

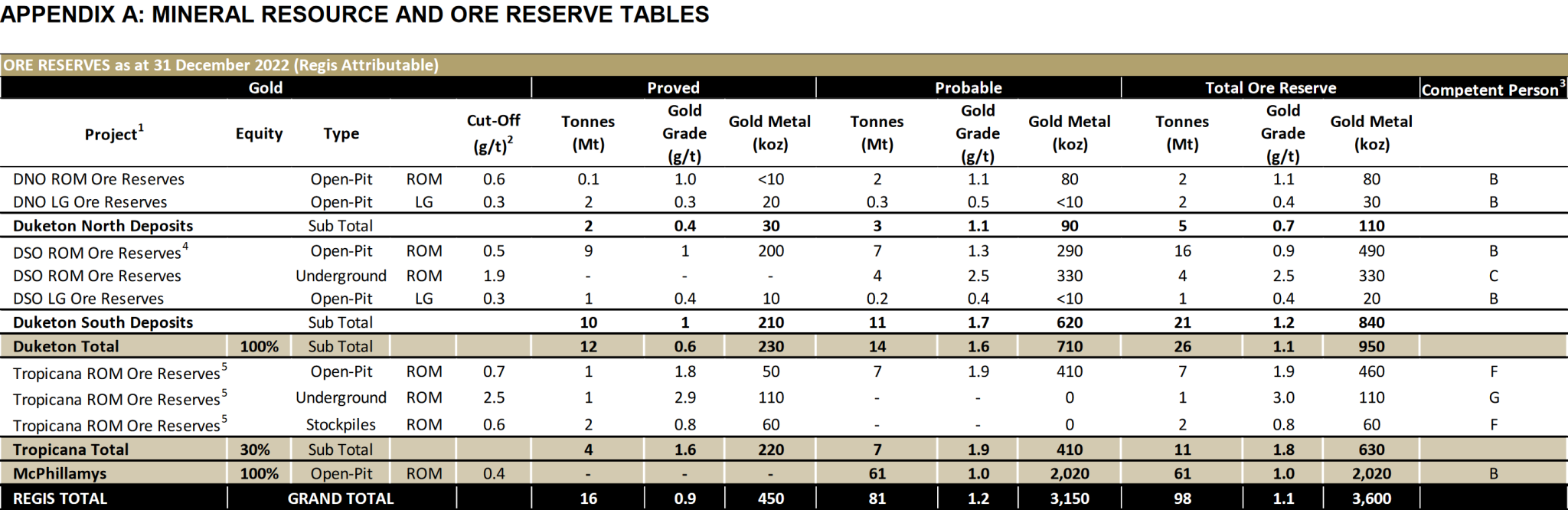

Below are the company’s reserves:

OTHER ASSETS

McPhillamys Gold Project NSW

BFS is expected in June 2024, but the estimated total capital cost is to be above $1.1b.

SUMMARY

Twiggy Forrest wanted to take his position to 20% at $1.48.

ASIC cost is around $2,300, but over $850 for D&A. Thus, the $1.6m existing WA reserve will generate around $550m profit.