Little Green Pharma (ASX: LGP) – focus on medicinal cannabis

COMPANY SCOREBOARD

| Pro Plus | Pro | Con Plus | Con |

|

|

|

|

ABOUT COMPANY

Little Green Pharma (LGP) (https://www.littlegreenpharma.com/) is a vertically integrated and pure-play medicinal cannabis company operating in Australia and Denmark. The company focuses solely on pharmaceutical-grade cannabis to treat medical conditions.

In March 2021, the company acquired its leased WA cultivation and manufacturing facility for $6m.

In June 2021, the company acquired a fully-operational GACP cultivation and GMP licensed medicinal cannabis asset in Denmark for C$20. It can produce over 20 tonnes of biomass per annum including 12 tonnes per annum of dried cannabis flower. The company realized a $25m book value gain in FY21.

https://companiesmarketcap.com/aud/cannabis/largest-cannabis-companies-by-market-cap/

CAPITAL STRUCTURE

| ASX Code | Share Price | Shares | Option (In) | Market Cap | Cash/Asset ($m) |

| LGP | 0.14 | 302872995 | 42402219.3000 | 1.4/69 |

| Holders No | Top 20 (Cur) | Top 20 (Pre) | Director Hold | Performance Right | Note |

| 11723 | 49.47% | 55.78% | 12.12% | 17147050 | last raise $5m@18c; pre raise $4m@20c+25cOpt |

the founder holds ~22m shares(7.25%), Thorney holds ~60m shares (19.8%, of which 25m was taken from Gina Rinehart at 11c in Oct 2024), altogether makes up 27% of the total capital.

BUSINESS

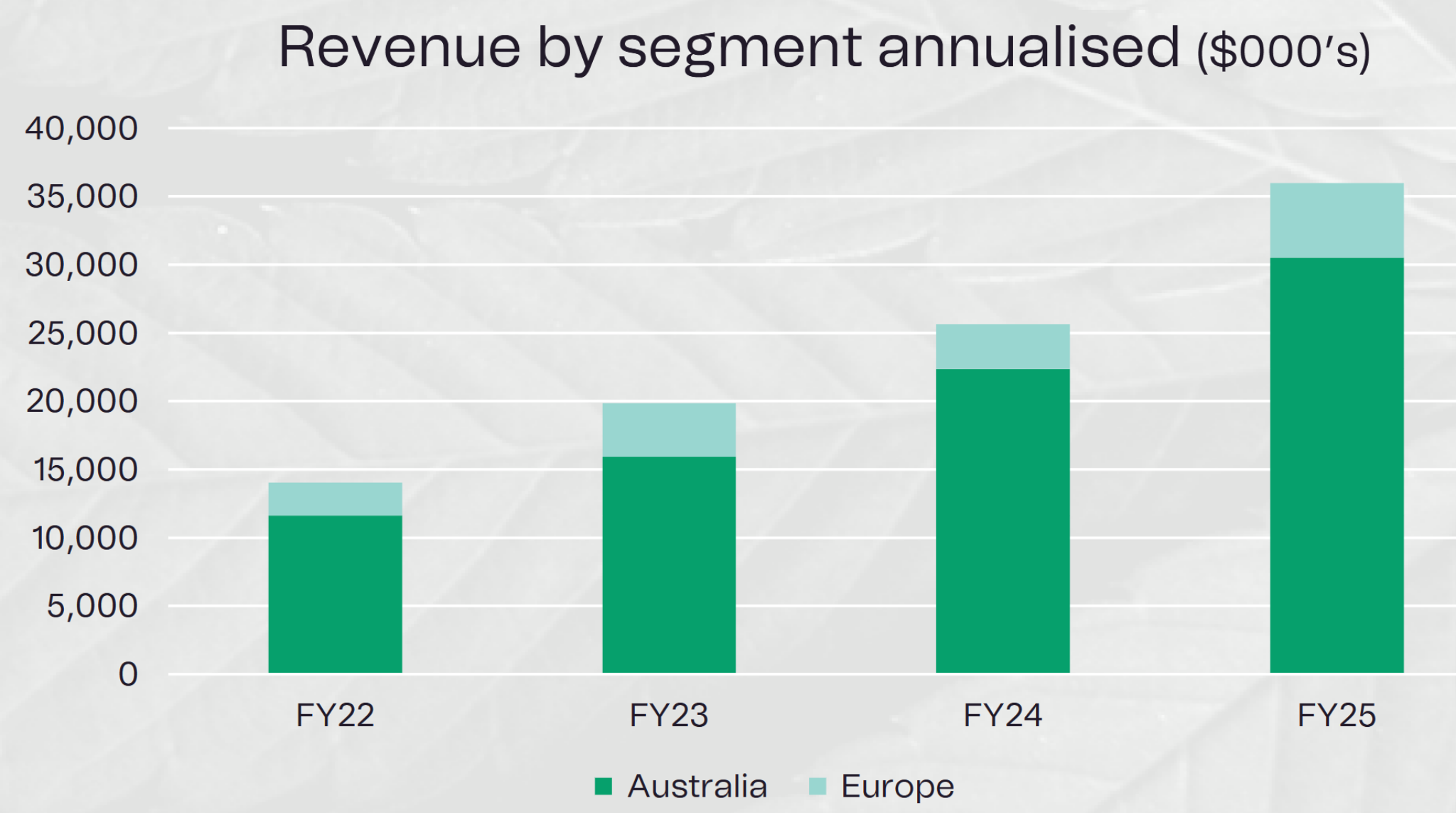

Below is the company past five years’ performance

| LGP | 2024 | 2023 | 2022 (9 month) | 2021 | 2020 |

| Operation Revenue | 25632 | 19859 | 10280 | 7004 | 2204 |

| Cost of Sale | -17579 | -9769 | -6329 | -2761 | -1085 |

| Gross Revenue | 8053 | 10090 | 3951 | 4243 | 1119 |

| Gross Margin | 0.3142 | 0.5081 | 0.3843 | 0.6058 | 0.5077 |

| Overheads | -17217 | -17556 | -22293 | -8208 | -7744 |

| Fixed Overheads | |||||

| Variable Overheads | |||||

| Total Operation Expense | -17217 | -17556 | -22293 | -8208 | -7744 |

| Operation Profit | -9164 | -7466 | -18342 | -3965 | -6625 |

| Other Revenue | 2349 | 3656 | -1738 | 28716 | -2385 |

| Interest Expense | -464 | -880 | -512 | -52 | -353 |

| D&A | |||||

| Income Tax | |||||

| Net Profit | -7279 | -4690 | -20592 | 24699 | -9363 |

| NOTES | $4.8m Demark commissioning cost | $8.6m Demark commissioning cost | $25m book value gain on Demark purchase |

SUMMARY

It is the best Cannabis company on ASX.