Dreadnought Resources (ASX: DRE) – 7,000 km2 in Kimberley & Gascoyne

COMPANY SCOREBOARD

| Pro Plus | Pro | Con Plus | Con |

|

|

|

ABOUT COMPANY

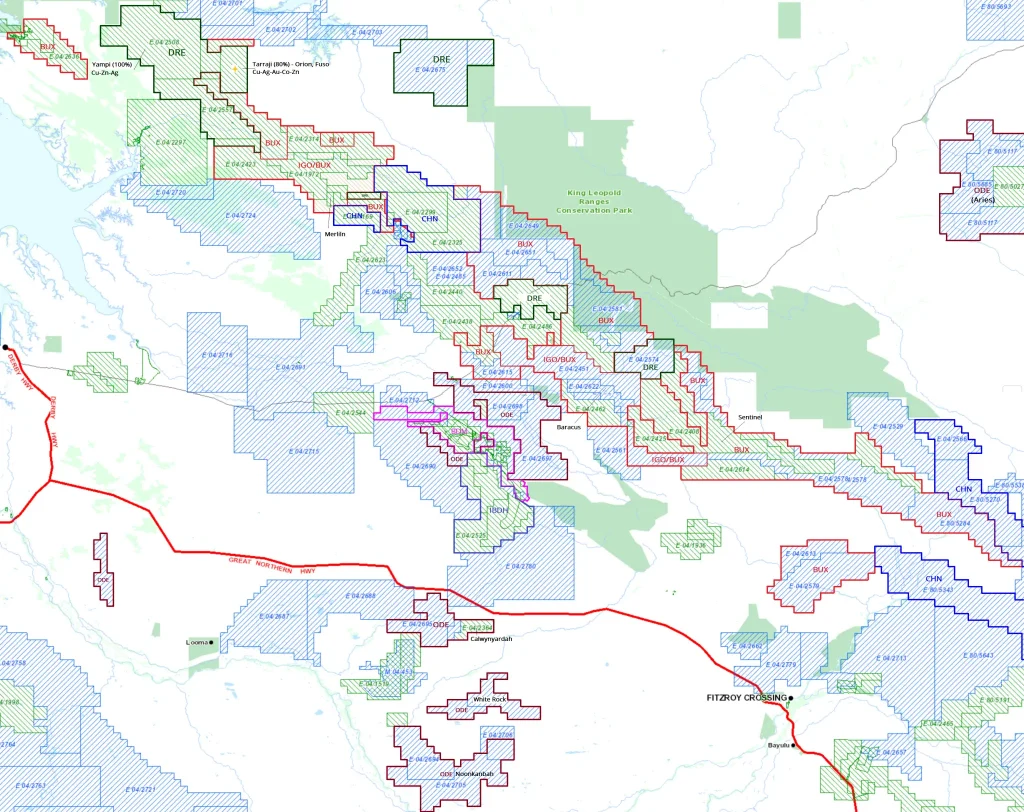

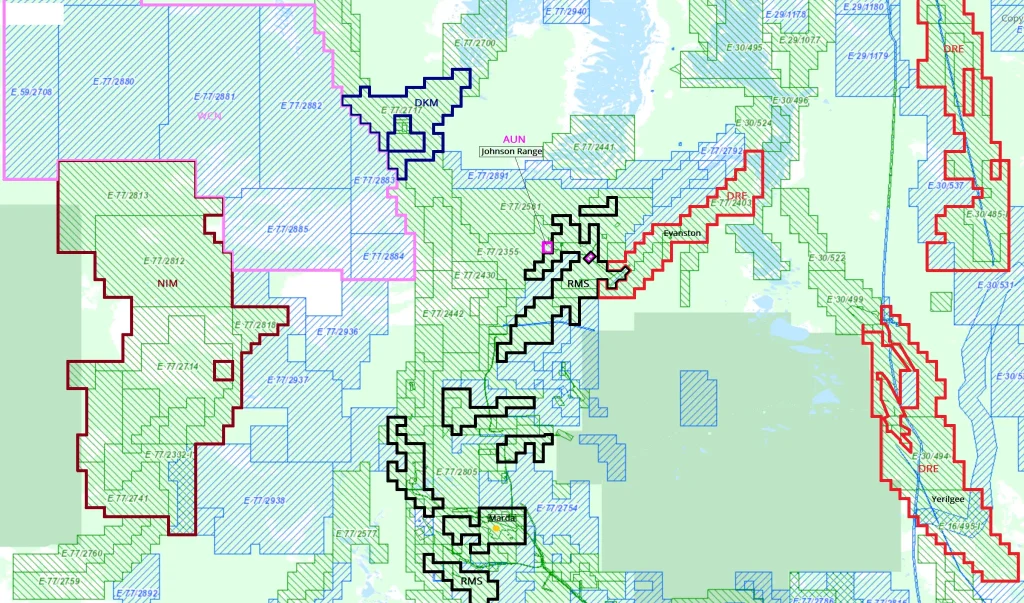

Dreadnought Resources (DRE) (https://www.dreadnoughtresources.com.au/) explores verities of minerals including gold, copper, nickel, PGE, and REE in Western Australia.

CAPITAL STRUCTURE

| ASX Code | Share Price | Shares | Option (In) | Market Cap | Cash/Asset ($m) |

| DRE | 0.015 | 4059133333 | 60886999.995 | 4/0 |

| Holders No | Top 20 (Cur) | Top 20 (Pre) | Director Hold | Performance Right | Note |

| 8210 | 29.61% | 26.90% | 12.33% | 68237500 | last raise $4.1m@1c; pre raise $5m@4.7c |

Total director’s 13% holding cost around $4.5m.

FLAGSHIP ASSETS

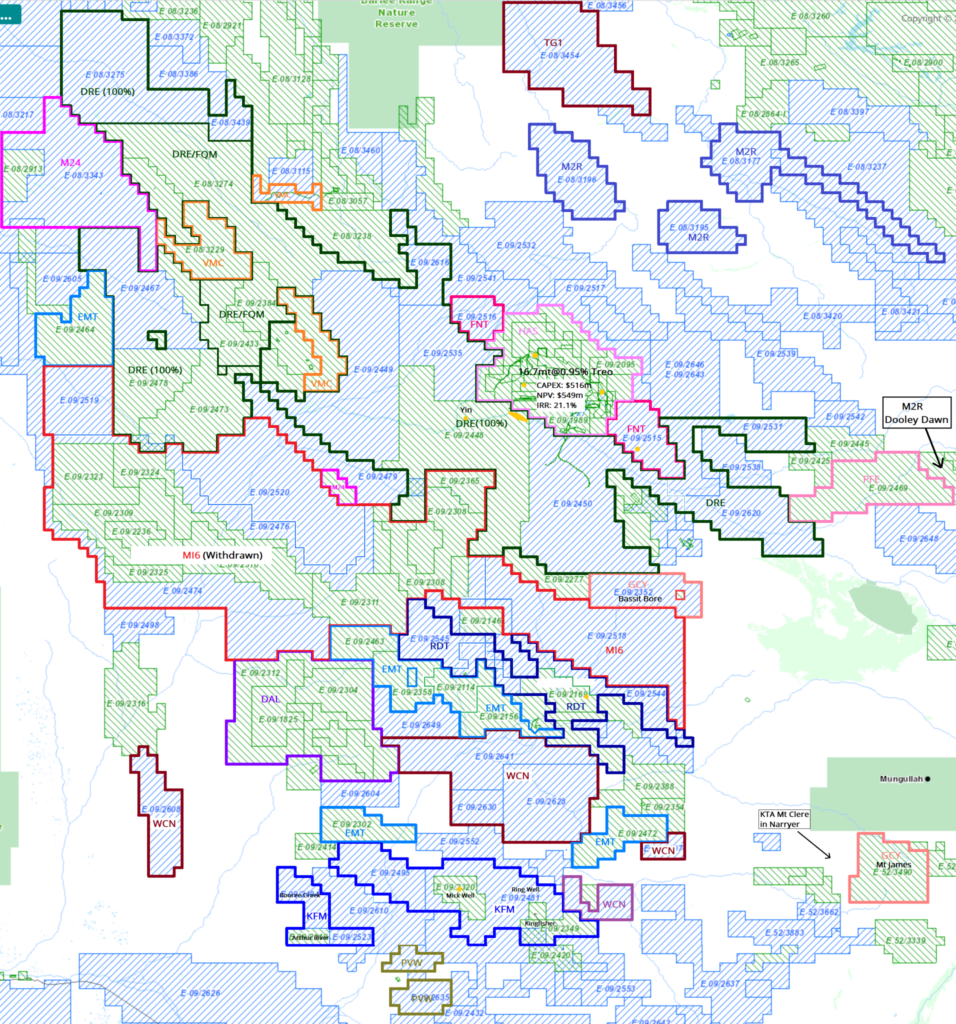

Mangaroon Ni-Cu-PGE REE Project Gascoyne WA (49% -100%)

Project Data

The company signed JV agreement with TSE:FQM for base metal rights over 5 tenements. The agreement provides FQM with the right to earn a 51% interest by spending $15m and a further 19% interest by sole funding all expenditure up until a Decision to Mine.

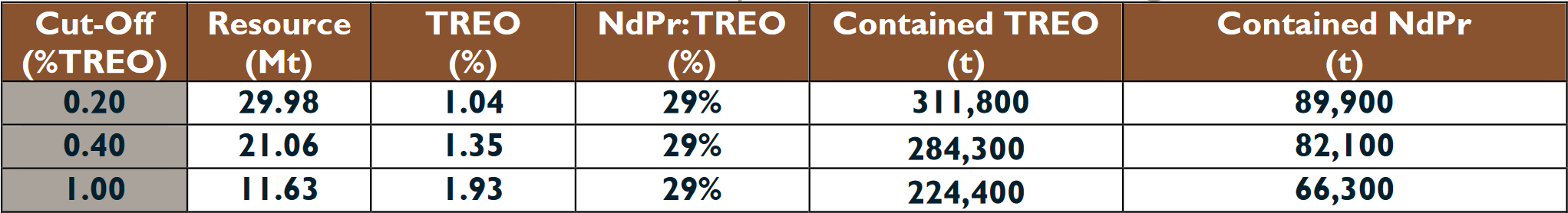

Its current resources might be a good addition to HAS (16.7Mt@0.95% for 194kt MREC), whose current resource base doesn’t support its development.

In June 2023, the company diversified its focus to gold.

Below are the project’s resources:

OTHER ASSETS

SUMMARY

If the company’s Yin resource turns out to be better than HAS‘s, there will be a corporate transaction between them.

However, the company is shifting its focus to gold in June 2023.