Horizon Minerals (ASX: HRZ) – developing 1Moz+ gold project

COMPANY SCOREBOARD

| Pro Plus | Pro | Con Plus | Con |

|

|

|

|

ABOUT COMPANY

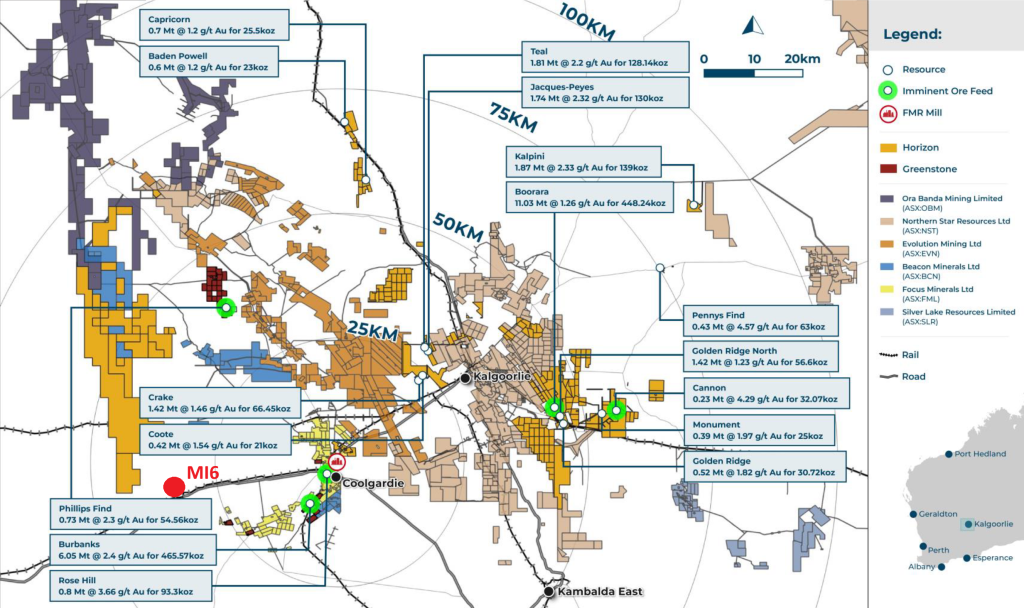

Horizon Minerals (HRZ) (https://horizonminerals.com.au/) owns a large portfolio of tenements in the Kalgoorlie and Coolgardie Regions WA. It currently focuses on developing the Boorara gold project and several small deposits around the same region.

In Feb 2024, the company announced script merge with GSR to consolidate tenements in the Coolgardie region, after which HRZ (701m) owns 63.1% of the merged entity while GSR owns the remaining 36.9% (409.5m), totaling 1,110.5m shares post merge.

In Oct 2024, the company announced script merge with POS (implying equity value of $30m@ar0und 4.5c) to use POS’s 2.2Mtpa nickel processing plant and convert to gold production as well as using Windarra’s water resources for gold taillings.

CAPITAL STRUCTURE

| ASX Code | Share Price | Shares | Option (In) | Market Cap | Cash/Asset ($m) |

| HRZ | 0.061 | 2140008556 | 130540521.916 | 19.2/2.7(US$5) |

| Holders No | Top 20 (Cur) | Top 20 (Pre) | Director Hold | Performance Right | Note |

| 5981 | 31.84% | 45.74% | 1.96% | 26004600 | last raise $23.6@4.5c; pre raise $3.34m@4.5c |

The company executed a US$5m Convertible Loan Facility with the interest rate of 8.5% plus Sofr, of which $2m is used to pay the previous Cannon acquisition.

The company holds 19.8m RVT@14c equals to $2.7m.

FLAGSHIP ASSETS

Kalgoorlie Gold Portfolio

Project Data

The 2021 & 2022 drilling programs haven’t delivered any resource increase, but only more confidence of existing resources.

The company signed Ore Sale Agreement for Boorara Project from Sep 2024, initially for 15% of the deposit. It also arranged Toll Milling Agreement for other smaller deposits.

In Oct 2024, it then changed strategy by acquiring POS and its nickel mill. It is yet to estimate the refurbishment cost.

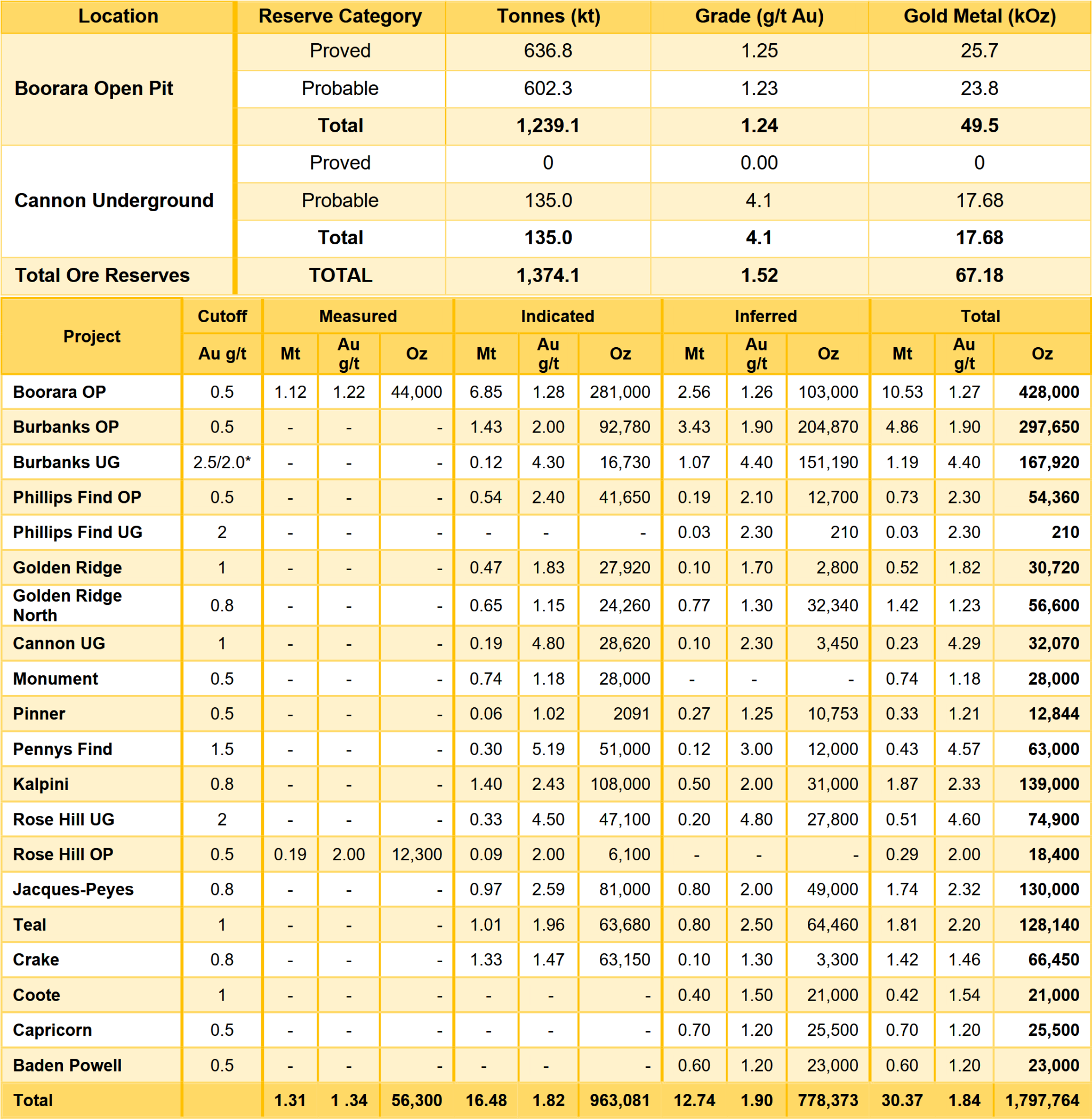

Below are the portfolio reserves and resources:

SUMMARY

The majority of the shareholders joined the HRZ train between 4c and 4.5c. It will need some consolidation at this level before the next leg up.

The company will need to assembly a credible team to complete the mill refurbishment.