Rox Resources (ASX: RXL) – develop Youanmi Gold Project

COMPANY SCOREBOARD

| Pro Plus | Pro | Con Plus | Con |

|

|

|

|

ABOUT COMPANY

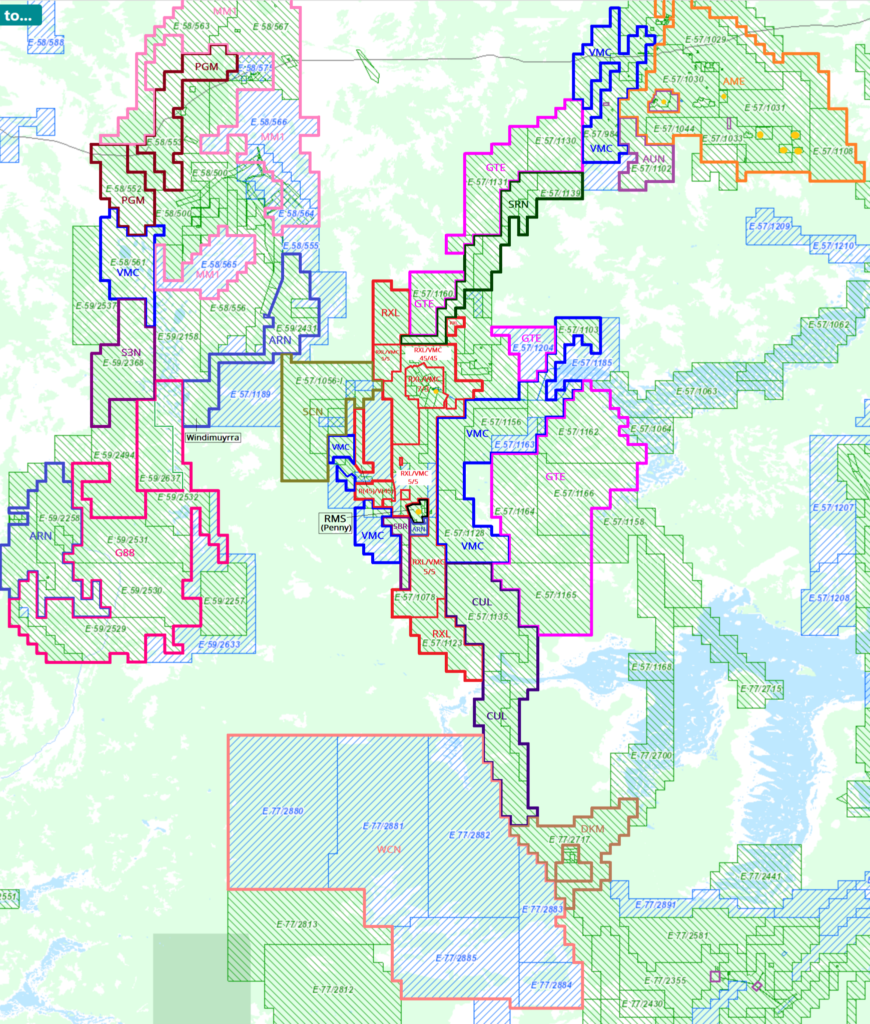

Rox Resources (RXL) (https://www.roxresources.com.au/) explores gold in Western Australia. Its flagship project is the Youanmi Gold Mine in WA. It also owns the Mt Fisher gold project.

CAPITAL STRUCTURE

| ASX Code | Share Price | Shares | Option (In) | Market Cap | Cash/Asset ($m) |

| RXL | 0.24 | 607883348 | 145892003.5200 | 26/0 |

| Holders No | Top 20 (Cur) | Top 20 (Pre) | Director Hold | Performance Right | Note |

| 6222 | 44.41% | 32.35% | 0.7% | 13020000 | last raise $27m@14c; pre raise $6.2m@16.5c+25cOpt |

Hawke’s Point holds 19.88% and Billionaire Chris Wallin holds 19.98% (i.e. 10.04% RXL and around 10% through VMC)

18.8m unlisted options@25c are expiring in November 2025.

The company made a number of changes on MD. Recently, Robert Ryan stepped down in Oct 2024, was replaced by Phillip Wilding who was COO from WGX.

The company had a share consolidation of 15:1 in July 2021.

FLAGSHIP ASSETS

Youanmi Gold Project WA

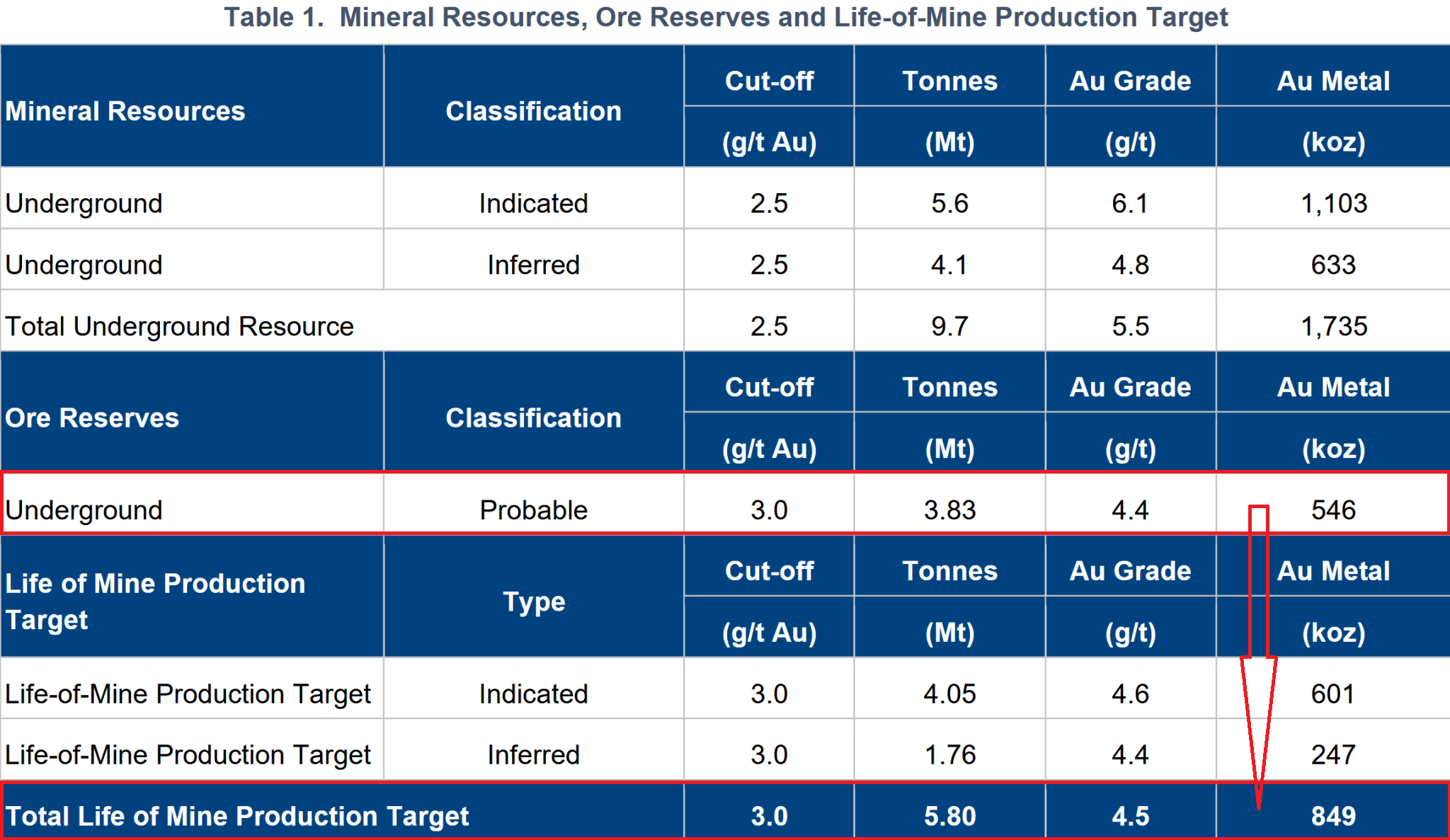

Below are the project’s reserves used for PFS in June 2024:

SUMMARY

Waiting on mid 2025 MRE update.