Medadvisor (ASX: MDR) – medication and adherence platform

COMPANY SCOREBOARD

| Pro Plus | Pro | Con Plus | Con |

|

|

ABOUT COMPANY

MedAdvisor (MDR) (https://www.medadvisor.com.au/) develops and delivers software for personal medication management in Australia and USA. It develops and deploys MedAdvisor, a medication and adherence platform that connects health professionals with patients using mobile and web technologies.

In November 2020, the company expanded to the USA via acquiring Adheris, LLC for up to US$34.5M ( AUD$49.0M@70c exchange) including US$7m earn-out.

In July 2022, the company acquired GuildLink from The Pharmacy Guild of Australia by placing $9.14m@16c to them. The Guildlink generated $7m and $7.5m revenue in FY21 and FY22 respectively.

CAPITAL STRUCTURE

| ASX Code | Share Price | Shares | Option (In) | Market Cap | Cash/Asset ($m) |

| MDR | 0.1 | 551965637 | 55196563.7 | 10/(18)(11) |

| Holders No | Top 20 (Cur) | Top 20 (Pre) | Director Hold | Performance Right | Note |

| 2600 | 80.49% | 80.48% | 1.55% | last raise $23.7m@14c;$5.25m@30c; pre raise $45m@38c |

In 2019, the company had 7 to 1 share consolidation.

In April 2021, it signed up a $12m loan facility (Due Dec 27) at a 15% interest rate to pay off the Convert Note and Earn-Out associated with the USA acquisition.

In November 2021, a director sold 6.8m (1/3) shares@36c from Kojent, the 5th largest holder. In 2023, he sold another sold 6.8m.

As of Jan 2025, Guild Group 95m (14c, 17.21%) is the largest shareholder; US health data analysis company Cotiviti holds 44m (38c, 7.98%), and EBOS holds 9.8% (40c in 2017, at the time, it was a largest holder at 14.1% of MDR’s then market cap of $67m) as well. Between Perennial (13.3%), Jencay Capital (5.1%) and Mercer Investments (5%).

BUSINESS

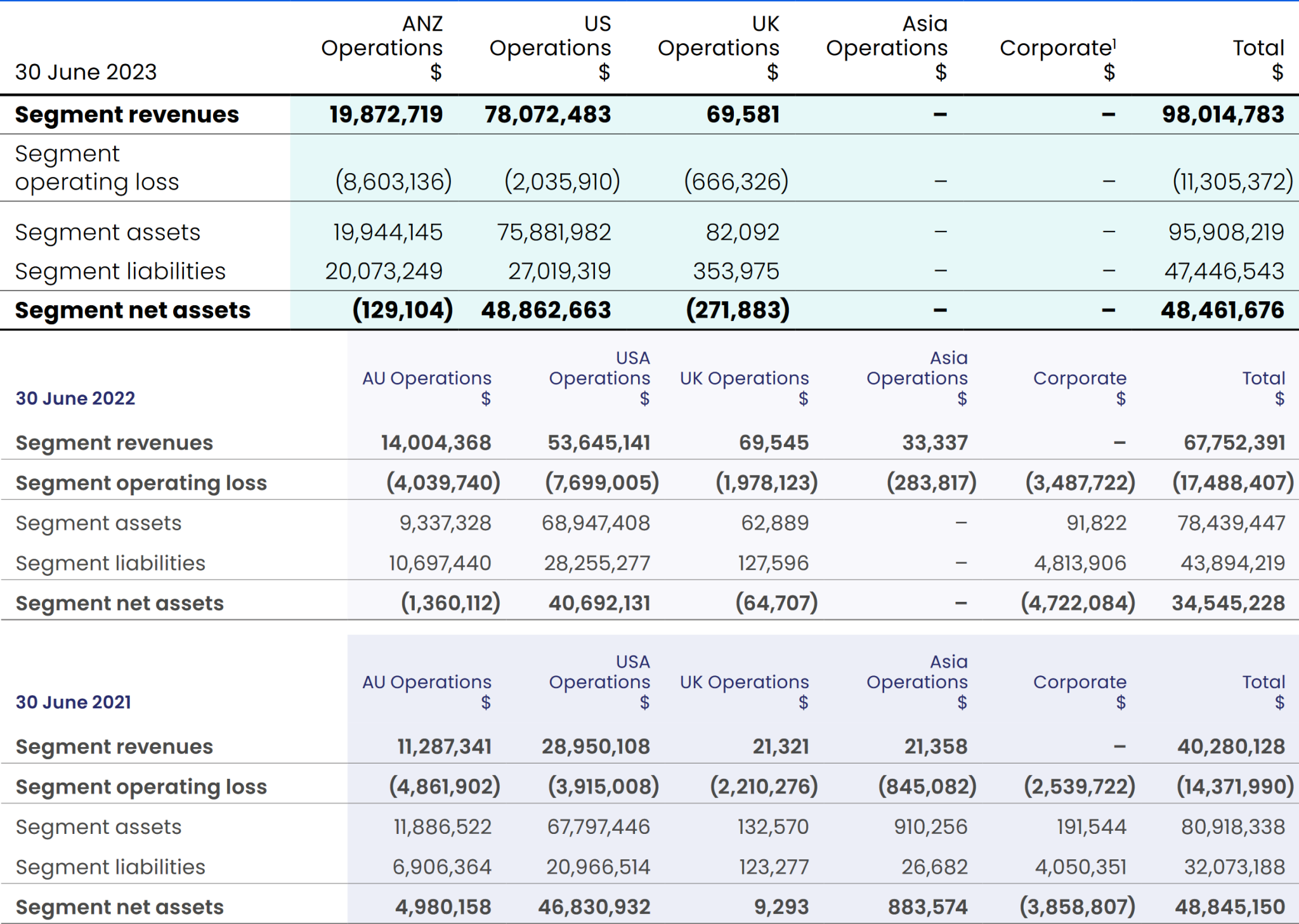

Below is the company’s past five years performance:

| MDR | 2024 | 2023 | 2022 | 2021 | 2020 |

| Operation Revenue | 122106 | 97963 | 67750 | 38773 | 9603 |

| Cost of Sale | -47857 | -38554 | -32758 | -17467 | -1221 |

| Gross Revenue | 74249 | 59409 | 34992 | 21306 | 8382 |

| Gross Margin | 0.6081 | 0.6064 | 0.5165 | 0.5495 | 0.8729 |

| Overheads | -67356 | -62238 | -46280 | -36407 | -19002 |

| Fixed Overheads | |||||

| Variable Overheads | |||||

| Total Operation Expense | -67356 | -62238 | -46280 | -36407 | -19002 |

| Operation Profit | 6893 | -2829 | -11288 | -15101 | -10620 |

| Other Revenue | -247 | 51 | 2023 | 435 | 1520 |

| Interest Expense | -1773 | -2134 | -1542 | -422 | -115 |

| D&A | -4195 | -5353 | -4900 | -3211 | -512 |

| Income Tax | -131 | -790 | 240 | 2855 | |

| Net Profit | 547 | -11055 | -15467 | -15444 | -9727 |

| NOTES |

In Australia, the company’s primary revenue is from PlusOne Pharmacy Software; it receives about $2,500 per pharmacy per year (ARR plus fees). There are 5,700 pharmacies in Australia; MDR has a market share of 65% in 2021. In July 2022, it acquired GuildLink, a direct competitor. As a result, the company’s software will cover 5,000+ pharmacies (or 90% of the market) and 2.9m+ patients. It generated around $24m revenue in FY23&24, half of which was SaaS, and another $3-$4m in transaction fees.

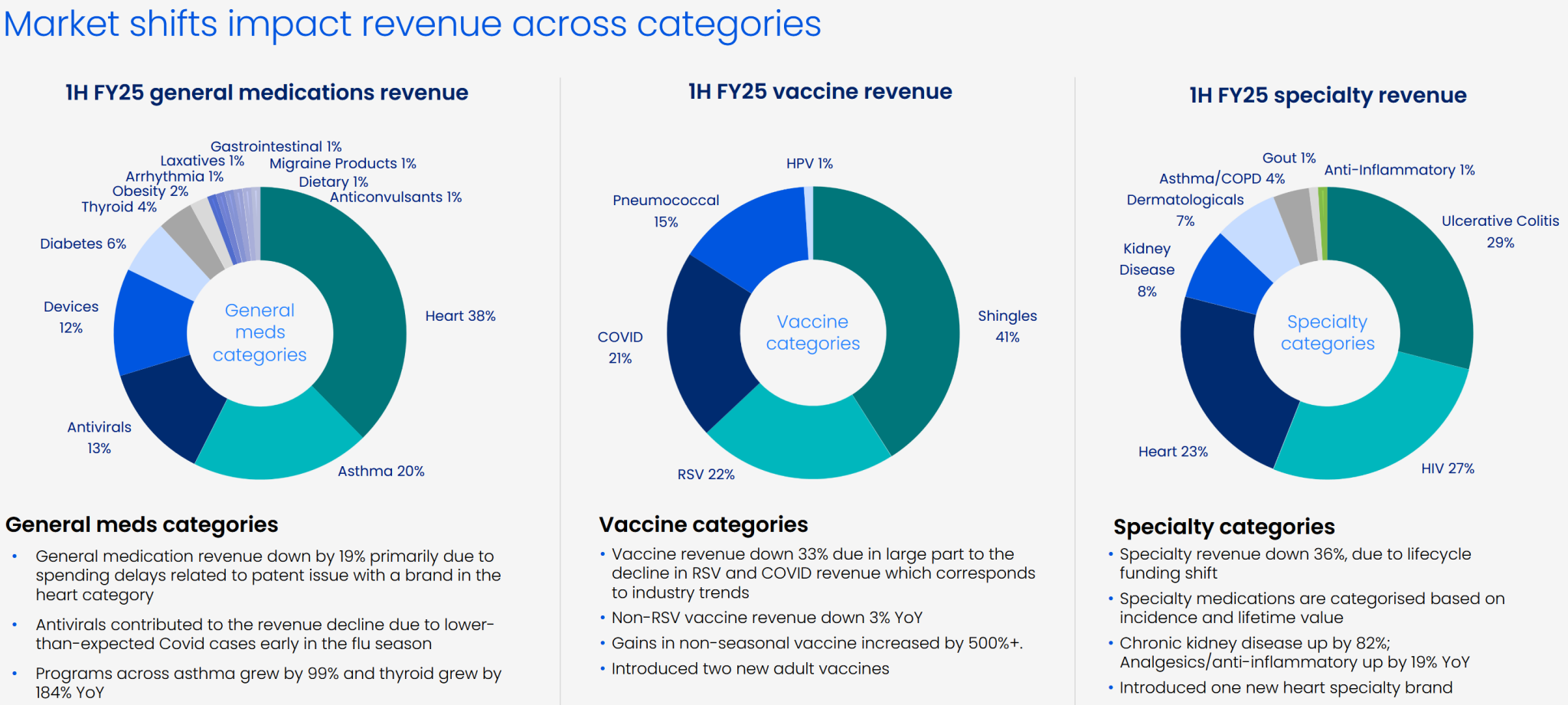

Its USA business model is yet to be analysed. 50% of the US revenue generated from vaccine, 37% from general medications.

SUMMARY

If the company is confident with its cashflow, it would have paid its very expensive loan.

If using Guildlink acquisition price as an indication, i.e. $9m for $7m revenue, then the current $23m ANZ revenue would equal to around $30m purchase price. US business was bought for $50m, it is unlike to sell above this value. If it is sold for $40m, after paying back the loan, it would only have $20m cash left, so altogether $50m market value. Given Guild involvement, it may be worth around $70-$80m at the best before we know what’s the company’s next growth point.

From another perspective, in 2019 before US acquisition, the company was generating around $10m in revenue, and valued at around $50-$60m market cap.